Abstract

The heterogeneity in income variability across Slovenian farms and time is explained by subsidies received by farm, off-farm income received by farm, and farm characteristics. Unbalanced and balanced farm-level panel data from the Slovenian farm accountancy data network are used to estimate coefficients of variation for gross farm revenues in less favoured areas (LFAs) and non-LFAs over the period 2004 to 2013. Gross farm income slightly increased over time with cyclical oscillations and an increase in the role of subsidies. Our estimations suggest that subsidies and off-farm income for non-LFA farms and farm specialisation for both LFA and non-LFA farms reduce farm income risk, whilst subsidies and farm size for LFA farms, and financial immobility for both LFA and non-LFA farms increase farm income risk. There is a non-linear relationship between farm size and income risk for LFA farms.

DOI: 10.30682/nm1803c

Stefan Bojnec*, Imre Fertő**

* University of Primorska, Faculty of Management, Koper – Capodistria, Slovenia.

** Institute of Economics, Centre for Economic and Regional Studies, Hungarian Academy of Sciences, Budapest, Hungary. Kaposvár University, Faculty of Business Administration, Kaposvár, Hungary.

Corresponding author: stefan.bojnec@fm-kp.si, stefan.bojnec@siol.net

1. Introduction

The paper deals with agricultural sustainability at the farm level, thereby helping address questions about how to measure and understand the drivers of farm income risk, including which determinants make farm income more or less risky, and are thus more sustainable in the long-term (Enjolras et al., 2014). Substantive complex research on agricultural sustainability has been developed under different assumptions using alternative definitions and approaches to sustainability, ranging from accounting-based resource sufficiency to functional integrity, as well as social responses. Latruffe et al. (2016) provide a comprehensive review of the indicators used in the literature to measure agricultural sustainability using a typology based on three sustainability components: environmental, economic and social. Our focus is on the economic aspect of sustainability, but this also has consequences for environmental and social sustainability.

Risk traditionally plays a considerable role in agricultural production because natural forces are beyond the control of farmers (Barry et al., 2001; Just and Pope, 2003). Besides its relevance at the farm level, income risks are also of significant policy relevance (el Benni et al., 2012; el Benni and Finger, 2013; Cimino et al., 2015). The existence of risk is also an important factor that is used to justify numerous governmental interventions in agriculture. It is crucial that policy design take expected risk behaviour into account in an accurate way and uncover unexpected behavioural responses (de Mey et al., 2016).

During the last decades a wealth of literature has emerged about the impacts of agricultural policy on farm income risks (el Benni and Finger, 2013; de Mey et al., 2014; Uzea et al., 2014; Severini and Tantari, 2015; de Mey et al., 2016, Severini et al., 2016). Previous research findings suggest that agricultural policy measures may affect farmers’ income risks via diverse pathways. Although the potential direction of the various individual effects of agricultural policy tools on farmers’ income risks are well known, it is difficult to provide an unambiguous assessment of impacts on income variability supported by a solid theoretical underpinning. Farm income instability can affect sustainability through the interaction of agriculture and the rural economy with institutional and policy issues.

This paper contributes new empirical findings and conclusions important for theory, practice and policy regarding farm income risk, and discusses the sustainability aspects of the research described herein. While extensive research into farmers’ risk management strategies in Western European countries already exists, our knowledge about Central and Eastern European agricultural producers’ behaviour is still limited (exceptions include Fertő and Stalgiené, 2016). The paper is an attempt to fill this gap. More specifically, the paper describes an analysis of the impacts of agricultural subsidies, off-farm income and farm characteristics on farmers’ risk in Slovenian agriculture. This is the first such study undertaken for Slovenia. Results are significant and robust for most of the explanatory variables that were analysed and thus are of broader agricultural sustainability and policy relevance.

The remainder of this paper is structured as follows: Section 2 summarizes developments in the Slovenian farm sector. Data and methods used are described in Section 3. Results are presented and discussed in Section 4 and Section 5. Finally, a summary and concluding remark are presented in Section 6.

2. Background to Slovenian Agriculture

While Slovenian agriculture shows some similarities in geographical and natural agricultural factor endowments and climatic conditions to other countries in Central and South Eastern Europe, its main specificities can be classified according to four main empirical and stylized features: first, agricultural collectivization in Slovenia, as well as in the rest of the former Yugoslavia and in Poland, failed during the communist period. Consequently, most farms and agricultural land remained under private ownership and operation. During the communist period, private farms were restricted in size and some institutional constraints were imposed. In comparison with some other ex-communist countries, the transition to a market economy did not induce radical changes in the persistent family-farm background of Slovenian agriculture. Family farms have remained relatively small and fragmented (Bojnec and Latruffe, 2013; Bakucs et al., 2013; Unay Gailhard and Bojnec, 2015). While average farm size has increased slightly due to a decline in the total number of farms, average farm size has remained relatively small in comparison to other European countries (Eurostat, 2017). In 2016, the average operational farm size in Slovenia was 6.8 hectares of (utilized) agricultural area. In addition, farms have on average 5.6 hectares of forest (SORS, 2016).

Second, agricultural production in Slovenia is handicapped by a weak natural agricultural factor endowment consisting of a relatively high share of farms operating in LFAs – among EU member states Slovenia is first in terms of percentage of farms and land operated in LFAs (Unay Gailhard and Bojnec, 2015, 2016; Barath et al., 2018). This specific situation is of relevance for agriculture and the countryside as a large percentage of farm income is derived from various subsidies, particularly in hilly and mountain areas (Knific and Bojnec, 2015), and may also be one of the reasons that Slovenian agriculture has always been heavily subsidized (OECD, 2001; Bojnec and Latruffe, 2013; Pintar, 2016).

Third, unlike in other post-communist countries Slovenia has followed a polycentric regional development approach that supports the existence of non-agricultural activities, local off-farm employment and income opportunities in smaller rural towns. In addition to employment abroad (particularly daily commuting to neighbouring Austria and Italy), off-farm employment and off-farm incomes have traditionally been important for Slovenian family farms. While off-farm income can increase household income and spending, it may also be an important factor in farm investment behaviour and farm efficiency (Bojnec and Fertő, 2013). Due to the persistence of financial constraints on farm investment, during the transition to a market economy family farm investment in Slovenia to a great extent relied on the owner’s own resources (Bojnec and Fertő, 2016).

Finally, smallholder family farms are often considered more subsistence-based by nature (Brookfield and Parsons, 2007; Lowder et al., 2016). On-farm production diversification activities can be seen as one of the survival strategies of smaller farms which may reduce market risk. In contrast to using economies of scope with division of on-farm labour and on-farm production diversification using the same farm capacity, farm specialisation can contribute to the exploitation of economies of scale. This may reduce average long-term costs and, in turn, improve farm cost competitiveness, but can also increase market and farm income risk as it pertains to a focus on specialized production. So far, the issue of farm specialisation in terms of agricultural sustainability and farm income risk has not been investigated for Slovenian agriculture.

3. Data and Methods

The effect of agricultural subsidies, off-farm income and farm characteristics on farm income risk in Slovenian agriculture is analysed using farm-level data from the Slovenian farm accountancy data network (FADN) for the period 2004–2013. The FADN is an unbalanced panel dataset. For the period 2004–2013, the Slovenian FADN contains a total of 8272 observations.

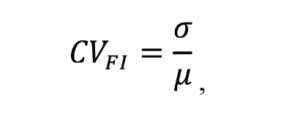

The analysis focuses on gross farm income. Farmers’ income risk is measured by the coefficient of variation (i.e. CV is the ratio of standard deviation and mean) at the farm level in order to facilitate comparison of income risks across farms and over time. Formally,

where σ is the standard deviation of farm income (FI), and μ is the mean of farm income over five years for each farm. Based on earlier research (see the surveys of el Benni et al., 2012; el Benni and Finger, 2013) we define the following five hypotheses (H1-5).

First, we assume that a high share of total subsidies in gross farm income reduces farmers’ income risk, as a risk-free income source. We use the share of total agricultural subsidy in gross farm income as a proxy for the subsidy. The level and structure of subsidies is tied to changes in the EU’s Common Agricultural Policy (CAP). Thus H1 is defined as follows:

H1: Farm income risk is negatively associated with the share of subsidies in gross farm income.

Second, farm financial immobility is defined as the share of fixed assets to total assets as a proxy for farm liquidity. Liquidity refers to a farm’s ability to generate sufficient cash to meet financial commitments when they occur. The higher the farm share of fixed to total assets (fixed assets being specified as fixed buildings and other fixed assets that cannot easily be used for other purposes which thus potentially represent higher sunk costs), the less financially immobile farms are, the lower the farm liquidity, and thus the higher the farm income risk: sudden drops in income due to a changing economic environment can be managed more easily if the liquidity of farm operations is high. Assuming liquidity to be an exogenous factor that determines the level of farm income risk, higher levels of liquidity with a lower share of fixed to total assets may allow a farmer to manage more risk and should therefore be negatively correlated with income risk. H2 is thus defined as follows:

H2: Farm income risk is positively associated with an increase in farm financial immobility.

Third, a body of literature argues for the importance of transforming the rural nonfarm economy and farm-nonfarm linkages, along with off-farm employment and farm income diversification, with policy implications for developed (Haggblade et al., 2007; Deichmann et al., 2008) and developing countries (Reardon et al., 2000). Off-farm income, which is important in Slovenian agriculture (Bojnec and Fertő, 2013), is one way for farmers to overcome farm income losses or to hedge against variability in farm income. The share of off-farm in gross farm income is used as a proxy for farmers’ dependence on off-farm income, which can reduce farm income risk. H3 is thus defined as follows:

H3: Off-farm income reduces farm income risk.

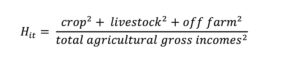

Fourth, diversification of farm activities is the usual risk management tool for reducing risk to gross farm revenues (Robison and Barry, 1987; Hardaker et al., 1997; Berg and Kramer, 2008). In contrast, specialisation is typically a source of economic efficiency via economies of scale that may increase net returns, but also increase the risk to farm income (Barnett and Coble, 2009). Hence, it is expected that an increase in farm specialisation will increase farm income risk. The degree of farm specialisation is measured using the Herfindahl (H) index, with gross farm revenues considered as the sum of revenues from crop and livestock production and off-farm income. The index ranges between 0 and 1, wherein the closer the value to 1, the higher the degree of specialization. For example, a farm specialized in crops or livestock production would have a H index close to 1. Formally,

where i denotes the farm and t is time.

H4 is thus defined as follows:

H4: Farm income risk is positively associated with the level of specialisation of the farm.

Fifth, farm size is usually considered to explain the level of farm income risk (Barry et al., 2001). The standard assumption is that bigger farms benefit from economies of scale and production efficiencies. Furthermore, larger farms may be able to more efficiently manage extreme events. Thus, the standard hypothesis is that farm income risk is negatively associated with farm size. We measure farm size in European Size Units (ESU). Sub-hypothesis H5a is defined as follows:

H5a: Farm income risk is negatively associated with farm size.

Moreover, large farms may sometimes face higher income risk due to a suddenly changing business environment. Thus, farms above a certain size can be more vulnerable to income risk, especially if they are specialized. To incorporate the non-linear relationship between farm size and farm income risk, a squared size term is added to our empirical model. Sub-hypothesis H5b is thus defined as follows:

H5b: There is non-linear relationship between farm size and income risk.

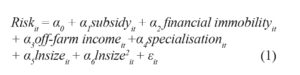

Our empirical model is thus the following:

where Risk refers to income risk for each farm i measured by the coefficient of variation of gross farm income for six five-year periods (2004-2008, 2005-2009, 2006-2010, 2007-2011, 2008-2012, and 2009-2013). All other variables are expressed as their five-year averages for each period. To control for periodic specific random shocks, we also add period dummies to our models.

Some issues needed addressing when the panel models were estimated. First, Hausman tests imply that fixed-effect models are preferred over random effect specifications. Second, modified Wald tests for groupwise heteroskedasticity in fixed-effect regression models indicated the presence of heteroskedasticity. Third, Wooldridge’s test for autocorrelation in panel data was conducted and the null hypothesis of no first order autocorrelation was rejected at the critical one percent significance level. Given these last two findings, the error structure was assumed to be heteroskedastic, autocorrelated to some lag, and possibly correlated between farms. Thus we employed robust Driscoll-Kraay standard errors using the xtscc program in STATA (Hoechle, 2007). The program uses a non-parametric technique and automatically selects the maximum lag that should be incorporated in the autocorrelation structure. To check the robustness of the results (Verardi and Croux, 2009), we estimated our models using both unbalanced and balanced panel datasets.

4. Results

Here we first present the descriptive statistics for gross farm income and means of variables, and then econometric results for drivers of farm income risk for the Slovenian FADN unbalanced and balanced samples.

4.1. Rescriptive Statistics

Figure 1 shows that gross farm income tends to increase cyclically, with small decreases in 2006, 2009, and 2011, and particularly in 2013. These drops can be explained by decreases in market income within gross farm income structure. Market income played an important role initially, but then declined. In 2013, total subsidies were more important than market income in the structure of gross farm income. The smaller share of off-farm income in gross farm income is rather stable and important in the structure of the gross farm income in Slovenia.

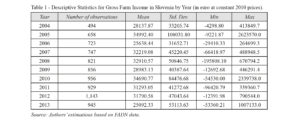

Table 1 shows the yearly descriptive statistics for gross farm income at constant 2010 prices. Average gross farm income undergoes cyclical development over time with peaks in 2005 and 2010 and troughs in 2006, 2009, 2011 and 2013. Much greater oscillations are seen in terms of the development of the maximum and minimum values for gross farm income, and consequently for the standard deviation of gross farm income. In comparison to Lithuania, for example, where the average and maximum values as well as the standard deviation of gross farm income tend to increase continuously while the minimum value of income tends to decline (Fertő and Stalgienė, 2016), Slovenian gross farm income shows greater volatility with a less distinct pattern of long-term development. Therefore, we investigate the drivers of gross farm income risk in Slovenia in terms of the coefficient of variations.

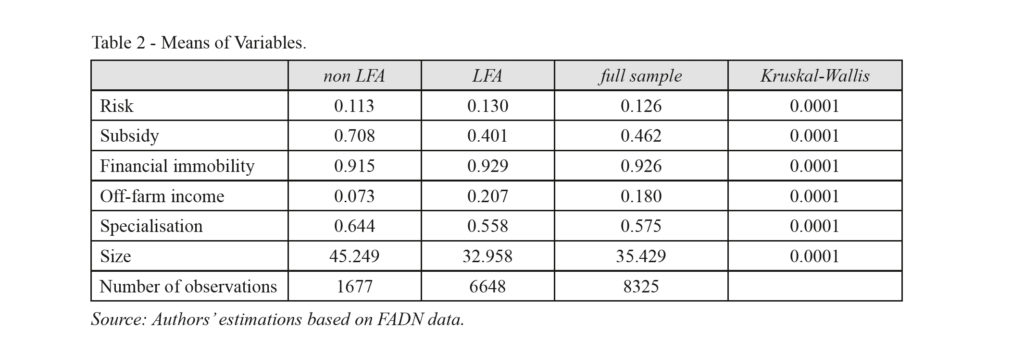

As can be seen from Table 2, the mean values for the dependent variable that was analysed (coefficient of variation of gross farm income) and explanatory variables indicate that non-LFA farms are of bigger size, received more subsidies, and are more specialized than LFA farms. In addition, non-LFA farms experienced slightly less risk and lower farm financial immobility arising from fixed assets, and had considerably less off-farm income than LFA farms. As LFA farms represent 79.9% of the Slovenian FADN sample of farms, the mean values of variables for the full sample of farms are closer to the mean values for LFA than for non-LFA farms. A Kruskal-Wallis H test confirmed that there was a statistically significant difference in the mean values of non-LFA and LFA farm variables.

4.2. Econometric Results

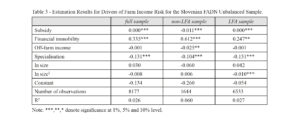

Table 3 shows the results of the three separate panel models for the unbalanced FADN sample, and separate results for non-LFA and LFA farms. The instability of gross farm income (i.e. the coefficient of variation) is explained by specified farm characteristics, subsidies and off-farm income. Unlike for Lithuania (Fertő and Stalgienė, 2016), total subsidy has a significant impact on gross farm income risk in Slovenia. However, the signs of the regression coefficients are different between LFA and non-LFA farms (positive for the former and negative for the latter). This implies the asymmetric impact of subsidies on farm income risk depending on their location: subsidies increase gross income risk for Slovenian LFA farms, but reduce, on average, that of bigger and more specialized non-LFA farms.

As expected, variable farm financial immobility positively influences farm income risk in all specifications, and the size of regression coefficients is greater, especially for non-LFA farms. Interestingly, farm financial immobility also has a positive sign for Lithuanian farms (Fertő and Stalgienė, 2016), but no significant impact on Swiss agriculture (el Benni et al., 2012).

Similarly as for Lithuania (Fertő and Stalgienė, 2016), a greater share of off-farm income reduces farm income risk. However, fully consistent with our third hypothesis is the fact that the regression coefficient for the non-LFA sample of farms is only statistically significant.

In contrast to the standard claim that farm size in ESU has a negative effect on gross farm income instability (for example, el Benni et al. [2012] for Swiss agriculture and Fertő and Stalgienė [2016] for Lithuanian agriculture), the regression coefficients for farm size in ESU are insignificant for Slovenia. Because it was hypothesized that this relationship might be non-linear, the coefficient of the squared terms of size variable is included. Only for LFA farms is the regression coefficient for farm size square significant, but it has a negative sign. This result implies that larger farms are becoming less income risky, a situation which can be explained by the fact that even larger farms in Slovenia are not large in comparison with those of some other countries. For example, this finding for Slovenia contrasts with findings of Fertő and Stalgienė (2016) for Lithuanian farms where a significant positive regression coefficient is reported, implying that large farms in Lithuania are also becoming more income risky. Accordingly, this difference in findings for farm size and firm size square between countries (i.e., between Slovenia and Lithuania) can be explained by the generalized empirical fact that farms in Lithuania are on average bigger than they are in Slovenia. More specifically, farms in Lithuania are on average bigger than the largest farms in Slovenia; one explanation for the possible differences in farm income risk sustainability behaviour between the two countries.

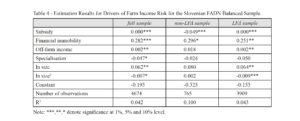

The model was re-estimated using balanced FADN panel data. Table 4 shows the results of the three separate panel models for the total balanced sample and separately for non-LFA and LFA farms. The regression coefficients are rather robust for subsidies and financial immobility. However, for the latter the regression coefficients between LFA and non-LFA farms are more similar in the balanced panel models.

The estimations highlight the problem of outliers, as various robust estimators of regression coefficients confirm. The negative regression coefficients that pertain to farm specialisation become significant, indicating that farm specialisation reduces gross farm income risk. The regression coefficient for farm specialisation is slightly higher for LFA farms than for non-LFA farms.

The substantial change in the balanced panel relates to the regression coefficients that pertain to off-farm income: significantly positive for LFA farms and non-significant for non-LFA farms. The former indicate possible instability in off-farm incomes for farms situated in LFAs due to the decline in some non-agricultural activities in rural areas which can cause gross farm income instability.

Not confirming the claim made in Hypothesis 5a, the significant positive regression coefficient for farm size in LFA suggests that farm size in ESU has a positive effect on gross farm income instability. This result is also inconsistent with the findings of el Benni et al. (2012) for Swiss agriculture and Fertő and Stalgienė (2016) for Lithuanian agriculture.

Similarly to with the unbalanced panel, in the balanced panel the regression coefficient for the squared terms of size variable is significantly negative, implying that the largest farms in Slovenian LFAs are becoming less income risky. This may be due to the growth in size of the biggest farms and adjustment towards a more optimal size, as they are still not very large. In addition, the biggest farms can to a greater extent rely on LFA subsidies and other related forms of government support which are linked to physical agricultural and farm size parameters, which are thus also linked in terms of ESU.

5. Discussion of Results of Hypotheses Testing

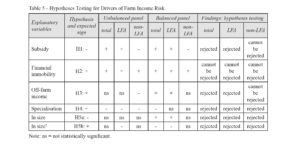

Our estimations are mixed regarding hypotheses testing (Table 5). The association between the share of subsidies in gross farm income and farm income risk is found to be asymmetric according to farm location: it is significantly negative for non-LFA farms and significantly positive for LFA farms. The former finding for non-LFA farms is consistent with H1 that agricultural subsidies reduce farm income risk. The latter finding for LFA farms that subsidies increase farm income risk can be explained by the high level of dependence of farms in LFA on subsidies, a situation which has been addressed by changes in CAP (Donati et al., 2015). These policy changes can induce adjustment costs, which are reflected in farm income risk, particularly for elderly and less educated farmers who lack knowledge and participate unsustainably in such CAP policy measures (Unay Gailhard and Bojnec, 2015, 2016). Considering the ongoing discussion about CAP reforms, these findings are largely in line with those of Pe’er et al. (2017) that subsidies can have a positive effect in supporting farm incomes, but create dependencies on them. LFAs subsidies can support more balanced territorial development, but do not adequately reduce inequalities due to the highly unequal allocation of payments and persistent low accessibility of funding for small farmers.

Consistent with our theoretical expectation in H2 is the fact that financial immobility increases income risk for both LFA and non-LFA farms. The greater the fixed farm assets as a proportion of total assets, the lower the farm liquidity and thus the higher the farm income risk.

H3 (off-farm income reduces farm income risk) cannot be rejected for the non-LFA balanced sample of farms, while other regression coefficients are not found to be significant. Due to a possible outlier effect, we conclude that off-farm income is an important component of farm income stability in non-LFAs.

Not lending support to H4 (which claims that the specialisation of farms is positively associated with income risk), our results for the unbalanced panel found a negative association for both LFA and non-LFA farms, while the regression coefficients are insignificant in the balanced panel. This finding implies that Slovenian farms have some opportunity to earn income from farm specialisation and the exploitation of economies of scale. Farms of smaller size can offset economies of scope through farm diversification activities by exploiting economies of scale through farm specialisation, which can increase efficiency and thus reduce farm income risk. This finding may reflect the transformation of the Slovenian farming system from the peasant agriculture of the past to a more specialized and commercial style of farming, which offers benefits through reducing farm income risk.

H5a and H5b are rejected for non-LFA farms as both farm size and the non-linear relationship between farm size square and farm income risk are found to be insignificant. While H5a and H5b are also rejected for LFA farms, the regression coefficients are significant, particularly in the balanced panel, but with the opposite regression signs to the findings of earlier research. These peculiar findings for Slovenia, which contradict previous studies that farm size increases farm income risk while farm size square reduces farm income risk, can be explained by the specific structural and natural conditions under which farming occurs in Slovenia. In addition, different signs for the regression coefficients of Lithuania (Fertő and Stalgienė, 2016) and our results for Slovenian farms indicate different farm income risk management behaviour. Slovenian farms to a large extent operate in LFAs. However, Slovenian farms in both LFAs and non-LFAs have similar farm size structural characteristics. More specifically, they are relatively small farms, which potentially constrain their efficiency (Barath et al., 2018).

A relatively low R2 for our panel regressions also suggests that farm income risk in Slovenia is related to some other unspecified drivers of farm income risk which have not been analysed. Agri-food trade competitiveness, adverse weather conditions and changes in climate with impacts on oscillations in agricultural production and in quantity of supply (Antle and Capalbo, 2010; Hart et al., 2017) and the risk of high food price volatility (Kalkuhl et al., 2016) may be among these unspecified drivers. Buckwell et al. (2017) argue that, to reduce risk, risk management policy approaches should address the variability of farmers’ income, with particular attention being paid to building long-term resilience and less to the level of farm income concerning short-term volatility. Crop insurance can be used to hedge against natural risks but raises costs, which may be the reason that a relatively small proportion of crop and agricultural production in Slovenia is insured (Žgajnar, 2017). While government support for mitigating damage caused by natural disasters has played an important role in Slovenian agriculture, its absolute and relative importance among all forms of government support has tended to decline during recent years (Pintar, 2016). Therefore, changes in climate and frequent natural disasters require agricultural sustainability measures which will help farmers adapt to the uncertainty associated with markets, changes in nature and climate, agro-technical and environmental conditions, and the policy changes which are causing farm income risks. Some studies have also indicated that countries in the Pannonian Plain and the southern Mediterranean part of Europe (in which a large proportion of Slovenian agriculture is located) will be among those areas of Europe more affected by climate change than northern Europe (which may be favoured by improvements in conditions for agricultural production (Fogarasi et al., 2016). This may also be one of the reasons for some of the differences in risk management behaviour which have been found between southern-European situated Slovenian agriculture and northern-European situated Lithuanian agriculture, for example. As natural and climatic conditions have different effects at different times of the year, farm technology, land management and risk management strategies should adjust production structures and farm income structures to increase their stability and long-term farm sustainability.

Other sources of unanalysed potential for mitigating the farm income risk of the smaller farm size structures which prevail in Slovenia is the development of eco-regions with organic farming, territorial rural development, and the sustainable rural livelihoods of small organic farms in LFAs (Schermer, 2005). The adoption of conservation agriculture by smallholders will require the ability of farmers to adopt and maintain such practices. Runhaar (2017) found for the Netherlands that trade-offs can occur between the nature conservation agricultural practices of farmers and intensive and large-scale farming. This calls for increases in the effectiveness of agri-environmental schemes and other conservation arrangements, while nature conservation should be mainstreamed into agricultural policies and farmers’ knowledge about agricultural sustainability. This ultimately implies a specific role for monitoring of the effects of agricultural policies and subsidies on agricultural sustainability, including farm income risk. Demand for the modernization and simplification of CAP is evident in the ongoing debate about the role of CAP in the agricultural sector and food security in a globalized market (ECORYS, 2017; EC, 2017) and in creating rural jobs (Schuh and Vigani, 2016).

6. Conclusions

The paper contributes to a better understanding of farm sustainability through its investigation measurement and explanation of the drivers of farm income risk in Slovenia. It provides new empirical evidence to substantiate empirical and policy statements and lessons learned about farm income risk behaviour, which is important for agricultural and rural sustainability at the farm level concerning the interaction between agriculture and the rural economy. Institutional and policy issues are found to be important for mitigating farm income risk in terms of theory, practice and policy. The novelty and contribution of this paper can be found in its analysis of the drivers of farm income risk and farm income risk behaviour of LFA and non-LFA farms in Slovenia. Mixed results about the drivers of farm income risk and farm income risk behaviour of LFA and non-LFA farms suggest some similarities and some specific farm managerial and policy implications for the management of farm income risk in a country with a significant proportion of LFA farms.

The research the paper is based on examines the impacts of agricultural subsidies, off-farm income and farm characteristics on gross farm income risk in Slovenian agriculture between 2004 and 2013 using FADN data. We find a slight increase in gross farm income over time, but this is associated with volatility during the period under analysis. Gross farm income was dominated initially by market income, but the most recent shift in income trends involved moving from a prevalence of market income to agricultural support, and the proportion of off-farm income decreased. Volatility in market income can be driven by oscillations in the quantity of production and supply, and associated volatilities in agri-food market prices. The former can depend on climate/weather conditions and their impact on yields, and the latter on market dependence on price volatility. The role of both climate and market on farm income volatility have not been investigated so remain issues for further research; our focus was on farm income risk driven by subsidies, off-farm income and specific farm characteristics.

Our estimations suggest that subsidies have asymmetric impacts: they reduce farm income risk for non-LFA farms but increase risk for LFA farms, which can be explained by the different levels of path dependence of farm income on subsidies and the process of adjustment to policy changes which can have different economic effects on farm income sustainability. The greater income risk dependence of LFA farms on subsidies can be explained by farm heterogeneity in income variability across farms and time, and production–environment–specific technology and managerial differences pertaining to the location of farms (see also Barath et al., 2018). This farm heterogeneity should be to a greater extent considered when making policy choices that seek to green agriculture and target subsidy measures for achieving more clearly defined sustainable economic, social and environmental policy objectives.

Having more fixed assets as a proportion of total assets increases income risk for both LFA and non-LFA farms. This finding is expected according to economic theory because a greater proportion of fixed asset specificity increases financial immobility and the sunk costs of existing fixed assets, and thus increases income risk. The finding also justifies the presence of investment subsidies among rural development policy measures: farm-specific investment can provide investment incentives and mitigate financial burdens for indebted farms.

Off-farm income reduces income instability for farms situated in non-LFAs. This may involve off-farm income-generating activity and employment opportunities in towns and villages closer to non-LFA farms, but less so for more geographically and infrastructurally remote LFA farms.

Farm specialisation is more likely to reduce farm income instability for both LFA and non-LFA farms, suggesting that the positive externalities of economies of scale offset economies of scope for still relatively small Slovenian farms on their path towards growth and commercialization.

For LFA farms, farm size increases farm income risk, except for in the biggest cases. This implies the potential for further adjustment and growth of farm income sustainability. Land leasing market transactions, the role of which have increased during recent years, may play a special role in increasing farm size, in addition to land markets.

Among the limitations of our research, the first is model specification. Later research could further specify models using additional explanatory variables that help distinguish between market and weather/climate dependence on farm income risk, and use additional farm and farm household characteristics as control variables. Second, among the natural, agriculturally enabling environmental variables, farm income risk may be affected by changes in the climate and weather conditions that impact agricultural production and quantity of supply. Also deserving of investigation is the income risk for different farm specialisations, the findings of which could then be linked to specific CAP measures and insurance schemes for mitigating farm income risk to help increase the sustainability of farm income.

Acknowledgements

This study has been supported by the bilateral project entitled “The impact of agricultural policy on farm income risk: a Hungarian-Slovenian comparison” between Hungarian (TET-16-2016-0072) and Slovenian (ARRS-BI-HU/17-18-001) Research Agencies.

References

Antle J.M. and Capalbo S.M., 2010. Adaptation of agricultural and food systems to climate change: An economic and policy perspective. Applied Economic Perspectives and Policies, 32(3): 386-417.

Bakucs L.Z., Bojnec Š., Fertő I. and Latruffe L., 2013. Farm size and growth in field crop and dairy farms in France, Hungary and Slovenia. Spanish Journal of Agricultural Research, 11(4): 869-881.

Barath L., Fertő I. and Bojnec Š., 2018. Are farms in less favoured areas less efficient? Agricultural Economics, 49(1): 3-12.

Barnett B.J. and Coble K.H., 2009. Are our agricultural risk management tools adequate for a new era? Choice, 24(1): 36-39.

Barry P.J., Escalante C.L. and Bard S.K., 2001. Economic risk and the structural characteristics of farm businesses. Agricultural Finance Review, 61(1): 74-86.

Berg E. and Kramer J., 2008. Policy options for risk management. In: Meuwissen M., Von Asseldonk M. and Huirne R. (eds). Income stabilization in European agriculture. Wageningen: Wageningen Academic Publishers, 143-167.

Bojnec Š. and Fertő I., 2013. Farm income sources, farm size and farm technical efficiency in Slovenia. Post-Communist Economics, 25(3): 343-356.

Bojnec Š. and Fertő I., 2016. Financial constraints and farm investments in Slovenia. New Medit, 15(4): 2-9.

Bojnec Š. and Latruffe L., 2013. Farm size, agricultural subsidies and farm performance in Slovenia. Land Use Policy, 32: 207-217.

Brookfield H. and Parsons H., 2007. Family farms: survival and prospects. A worldwide analysis. New York: Routledge.

Buckwell A., Matthews A., Baldock D. and Mathijs E., 2017. CAP – Thinking Out of the Box: Further modernisation of the CAP – why, what and how? Brussels: RISE Foundation.

Cimino O., Henke R. and Vanni F., 2015. The effects of CAP greening on specialised arable farms in Italy. New Medit, 14(2): 22-31.

Deichmann U., Shilpi F. and Vakis R., 2008. Spatial specialization and farm-nonfarm linkages. World Bank Policy Research Working Paper No. 4611, Washington, DC.

de Mey Y., Van Winsen F., Wauters E., Vancauteren M., Lauwers L. and Van Passel S., 2014. Farm-level evidence on risk balancing behavior in the EU-15. Agricultural Finance Review, 74(1): 17-37.

de Mey Y., Wauters E., Schmid D., Lips M., Vancauteren M. and Van Passel S., 2016. Farm household risk balancing: empirical evidence from Switzerland. European Review of Agricultural Economics, 43(4): 637-662.

Donati M., Menozzi D. and Fioravanzi M., 2015. Understanding farmers’ responses to CAP reform. New Medit, 14(3): 29-39.

ECORYS, 2017. Modernizing and simplifying the Common Agricultural CAP: Summary of the results of the Public Consultation. Analysis for European Commission, DG for Agriculture & Rural Development.

EC (European Commission), 2017. Modernising and Simplifying the Common Agricultural Policy. Summary of the results of the public consultation. DG for Agriculture & Rural Development, Brussels.

El Benni N. and Finger R., 2013. Gross revenue risk in Swiss dairy farming. Journal of Dairy Science, 96(2): 936-948.

El Benni N., Finger R. and Mann S., 2012. Effects of agricultural policy reforms and farm characteristics on income risk in Swiss agriculture. Agricultural Finance Review, 72(3): 301-324.

Enjolras G., Capitanio F., Aubert M. and Adinolfi F., 2014. Direct payments, crop insurance and the volatility of farm income: some evidence in France and in Italy. New Medit, 13(1): 31-40.

Eurostat, 2017. Farm structure statistics. Luxembourg: Eurostat. (accessed on 2 May 2017). http://ec.europa.eu/eurostat/statistics-explained/index.php/Farm_structure_statistics.

Fertő I. and Stalgienė A., 2016. Effects of agricultural subsidies on income risk in Lithuanian dairy farms. Management Theory and Studies for Rural Business and Infrastructure Development, 38(4): 351-358.

Fogarasi J., Kemény G., Molnár A., Keményné Horváth Z., Zubor-Nemes A. and Kiss A., 2016. Modelling climate effects on Hungarian winter wheat and maize yields. Studies in Agricultural Economics, 118(2): 85-90.

Haggblade S., Hazell P. and Reardon T. (eds.), 2007. Transforming the rural nonfarm economy. Baltimore: Johns Hopkins University Press.

Hardaker J.B., Huirne R. and Anderson J.R., 1997. Coping with risk in agriculture, 1st ed. Wallingford: CABI Publishing.

Hart K., Allen B., Keenleyside C., Nanni S., Maréchal A., Paquel K., Nesbit M. and Ziemann J., 2017. The consequences of climate change for EU agriculture. Follow-up to the COP21 – UN Paris climate change conference. DG for Internal Policies, Agriculture and Development.

Hoechle D., 2007. Robust standard errors for panel regressions with cross-sectional dependence. Stata Journal, 7(3): 281-312.

Just R.E. and Pope R.D., 2003. Agricultural risk analysis: adequacy of models, data, and issues. American Journal of Agricultural Economics, 85(5): 1249-1256.

Kalkuhl M., von Braun J. and Torero M., eds. 2016. Food Price Volatility and Its Implications for Food Security and Policy. Switzerland: Springer International Publishing.

Knific K. and Bojnec Š., 2015. Agricultural holdings in hilly-mountain areas in Slovenia before and after the accession to the European Union. Eastern European Countryside, 21: 19-34.

Latruffe L., Diazabakana A., Bockstaller C., Desjeux Y., Finn J., Kelly E., Ryan M. and Uthes S., 2016. Measurement of sustainability in agriculture: a review of indicators. Studies in Agricultural Economics, 118(3): 123-130.

Lowder S.K., Skoet J. and Raney T., 2016. The number, size, and distribution of farms, smallholder farms, and family farms worldwide. World Development, 87: 16-29.

OECD (2001). Review of agricultural policies: Slovenia. Organisation for Economic Co-operation and Development, Paris.

Pe’er G., Lakner S., Müller R., Passoni G., Bontzorlos V., Clough D., Moreira F., Azam C., Berger J., Bezak P., Bonn A., Hansjürgens B., Hartmann L., Kleemann J., Lomba A., Sahrbacher A., Schindler S., Schleyer C., Schmidt J., Schüler S., Sirami C., von Meyer-Höfer M. and Zinngrebe Y., (2017). Is the CAP fit for purpose? An evidence-based fitness check assessment. Leipzig, German Centre for Integrative Biodiversity Research (iDiv), Halle-Jena-Leipzig.

Pintar M. (ed.), 2016. Poročilo o stanju kmetijstva, živilstva, gozdarstva in ribištva 2015. Ljubljana: Kmetijski inštitut Slovenije in Ministrstvo za kmetijstvo, gozdarstvo in prehrano. http://www.kis.si/f/docs/Porocila_o_stanju_v_kmetijstvu_OEK/ZP-2015-splosnopriloge-NET.pdf (accessed on 2 May 2017).

Reardon T., Taylor J.E., Stamoulis K., Lanjouw A. and Balisacan P., 2000. Effects of nonfarm employment on rural income inequality in developing countries: an investment perspective. Journal of Agricultural Economics, 51(2): 266-288.

Robison L.J. and Barry P.J., 1987. The competitive firm’s response to risk. New York, NY: Macmillan.

Runhaar H., 2017. Governing the transformation towards ‘nature-inclusive’ agriculture: Insights from the Netherlands. International Journal of Agricultural Sustainability. http://dx.doi.org/10.1080/14735903.2017.1312096.

Schermer M., 2005. The impact of eco-regions in Austria on sustainable rural livelihoods. International Journal of Agricultural Sustainability, 3(2): 92-101.

Schuh B. and Vigani M., 2016. The role of the EU’s Common Agricultural Policy in creating rural jobs. DG Internal Policies, European Parliament, Brussels.

Severini S. and Tantari A., 2015. Which factors affect the distribution of direct payments among farmers in the EU Member States? Empirica, 42(1): 25-48.

Severini S., Tantari A. and Di Tommaso G., 2016. The instability of farm income. Empirical evidences on aggregation bias and heterogeneity among farm groups. Bio-based and Applied Economics, 5(1): 63-81.

SORS, 2016. Number of farms. Ljubljana: Statistical Office of the Republic of Slovenia. http://www.stat.si (accessed on 1 October 2016).

Unay Gailhard İ. and Bojnec Š., 2015. Farm size and participation in agri-environmental measures: Farm-level evidence from Slovenia. Land Use Policy, 46: 273-282.

Unay Gailhard İ. and Bojnec Š., 2016. Sustainable participation behaviour in agri-environmental measures. Journal of Cleaner Production, 138: 47-58.

Uzea N., Poon K., Sparling D. and Weersink A., 2014. Farm support payments and risk balancing: Implications for financial riskiness of Canadian farms. Canadian Journal of Agricultural Economics, 62(4): 595-618.

Verardi V. and Croux C., 2009. Robust regression in Stata. Stata Journal, 9(3): 439-453.

Žgajnar J., 2017. Analysis of indemnification of income risk at sector level: the case of Slovenia. Studies in Agricultural Economics, 119(2): 70-76.