Abstract

EU agricultural integrated policies among the EU and the southern Mediterranean countries are more evidently distilled through the EU-Mediterranean process (EUROMED). After 10 years of the Agadir agreement entry into force, this paper attempts to assess the agriculture trade integration among countries signed under the agreement, namely Morocco, Tunisia, Egypt and Jordan, by evaluating firstly the degree of sectorial and geographical dispersion of the four countries agricultural exports and secondly appraising the extent of agricultural trade complementarity towards EU countries. In this study, using the available agricultural trade data for the period 2007-2016 and the twenty-four agricultural sectors classification (CN codes 01-24), we will build three trade indices; Regional Hirschman, Sectorial Hirschman and the Trade Complementarity Index. And, finally, we will discuss the result and highlight the limitation and the challenges that hinder agricultural trade integration among southern and northern Mediterranean countries.

DOI: 10.30682/nm1903b

Mohamed Amine Hedoui*, Dimitrios Natos**, Konstadinos Mattas**

* Department of Business Economics and Management, Mediterranean Agronomic Institute of Chania, Greece.

** Department of Agricultural Economics, Aristotle University of Thessaloniki, Greece.

Corresponding author: natos.dimitrios@gmail.com

Cite this Item: Hedoui M. A., Natos D., Mattas K. EU Agricultural Integrated Policies: The Case of EU and Mediterranean Counties, New Medit, 18 (3): pp. 17-29, http://dx.doi.org/10.30682/nm1903b

1. Introduction

The EU Common Agricultural Policy, in the recent decades, has also been evolved through the necessities and the conditions that the world agricultural markets and economy are imposing. Furthermore, challenges such as market access, Common Agricultural Policy reforms and trade barriers have been shaping the EU integrated agricultural policies among the EU and the southern Mediterranean counties ever since. Conjointly, during the two last decades, the world has witnessed an increase in different regional agreements among countries. The average WTO member now has agreements with more than 15 countries. In fact, there is a global consensus among researchers [1], [2] and multilateral institutions (OECD, World Bank, IMF…) that the more the country is open to international market, the faster its economy grows. According to a report of OECD [3], «More open and outward-oriented economies consistently outperform countries with restrictive trade and [foreign] investment regimes». Since global competition has rapidly escalated, it has become inevitable for countries to liberalize their economy and to open up to implement export and foreign investment policies. Most of the countries have built up and strengthened their trade relations through various arrangements from colonial preferences to bilateral treaties to regional agreements based on geographical proximity and economic similarity with the purpose of spreading the socio-economic benefits of globalization. In this context, the EU agricultural integrated policies among the EU and the southern Mediterranean countries is more evidently distilled through the Euro-Med agreement.

The Euro-Med agreement [4] is one of the most important trade arrangements in the Mediterranean area. It went through several attempts to settle a strong trade relation between the EU and southern Mediterranean countries that could help them be attractive locations for both domestic and foreign producers and investors. The first framework to establish a global cooperation with southern Mediterranean countries was in 1972 with the Global Mediterranean Policy (GMP) [5], which led eventually to the conclusion of bilateral economic agreements with twelve Mediterranean countries [6]. However, the GMP was not as global as it sounds. Since the Mediterranean region was composed of vastly different countries from political, economic and cultural perspectives, there was a huge difference among European member states on how to manage international relations with the other approached Mediterranean states, especially with respect to trade recession. Moreover, all the focus in these periods was devoted to the political changes in the Eastern European and post-communist states that were motivated by the promises of future membership [7]. Therefore, a need to reexamine foreign policy agenda towards the Mediterranean area had arisen from the European Community, notably Spain and France.

It wasn’t until the Barcelona conference in 1995 [8], [9] that 15 EU member states and 12 Eastern and Southern Mediterranean countries signed a new Euro-Mediterranean partnership called the “Barcelona declaration” aiming to strengthen trade integration both in North-South and South-South directions and generating new opportunities to the actors of both sides of the Mediterranean through Euro-Mediterranean Agreements (EMAs). The main economic target of the process was to establish a Mediterranean Free Trade Area (MEFTA) by the year 2010 according to three main long-term objectives which are: speeding up the process of a sustained economic and social development, improving living conditions and encouraging cooperation and regional integration.

Nevertheless, agricultural trade remains the weakness of the deep-integration approach framing the Barcelona process. Despite the fully bilateral industrial trade, agricultural trade, as stated in the declaration, will comply with the «starting point traditional trade flows, and as far as the various agricultural policies allow and with due respect to the results achieved within the GATT negotiations, trade in agricultural products will be progressively liberalized through reciprocal preferential access among parties…». Togan (1998) [10] declared that the EU didn’t offer serious concessions to Southern Mediterranean countries regarding their agricultural exports and most of the agricultural EMAs have been postponed or rejected by certain EU members that stemmed the provision of some agricultural products. In fact, the EU’s political position was affected by the strong competition for the typical Mediterranean products. Therefore, all EMAs signed after the Barcelona declaration gave rise to non-tariff barriers that turned out to be replaced by barriers even stronger than old measures at least in the early first years following the Barcelona Declaration [7]. On the other hand, in order to meet the European Union agricultural requirements, southern Mediterranean countries need to face challenges to benefit from the preferential treatments. According to Garcia-Alvarez-Coque (2002) [11], the “hub and spoke” effect is one of the strongest challenges facing SMCs. This effect is represented by the possibility of “verticalization” of trade relations. The EU may be the hub and the southern Mediterranean countries may be the spokes. In terms of Foreign Direct Investment (FDI), investors will not find incentives to invest in SMCs without serious domestic reforms that will appeal to them. Concerning agriculture trade, given its weak inclusion in the negotiations of the Barcelona process, it would lead eventually to lesser private investments. Yet, regardless of the European intention to offer non-significant agricultural concessions on southern imports, EMAs have been commonly considered as a challenging opportunity for SMCs to modernize the private sector (including the agricultural sector) and build up a sustainable economy that could compete equally in a free global market.

2. The Agadir agreement

Meanwhile in the 4th Euro-Med Conference of Foreign Ministers in 2000 held in Marseille, there was a growing consensus of opinion among Euro-Med partners that stressed the need to support south-south integration. Foreign Ministers mentioned in article 17 of their Presidency’s formal conclusions of the 4th Euro-Med Conference of Foreign Ministers that: «The Ministers reaffirmed the full relevance of the objectives adopted in Barcelona in 1995 with a view to establishing an area of shared prosperity in the Mediterranean. Having reaffirmed the objective of creating a free-trade area by 2010, the Ministers stressed the need for the partner countries, with the support of the European Union, to open up further to one another economically in order to foster their successful integration into the world economy». In fact, southern Mediterranean partners had no incentive to liberalize politically and economically with their neighbors as long as they benefit from complete access to the EU market. Hence, the hub and spoke effect was consequently being created, making Mediterranean firms and private investors prefer to install themselves in the EU since they can easily access all the spokes in the Mediterranean [12]. According to the EU commission in its assessment after ten years of the Barcelona Declaration [13], Southern partners of the Euro-Med partnership are hindering the 2010 objectives by creating the hub and spoke effect and blocking the intra-regional investments. In turn, EU members see that supporting south-south integration becomes inevitable. Morocco, Tunisia, Egypt and Jordan were the first countries to express a desire to establish closer links by creating a free-trade area among themselves while the EU will provide the suitable back-up in favor of these south Mediterranean cooperation. Then in May 2001, the four foreign ministers launched the “Agadir Process” and since then senior officials and technical experts in trade from Morocco, Tunisia, Egypt and Jordan have met several times to discuss the technical features concerning the free trade agreement among these countries, until February 2004 when the “Agadir Agreement” was signed in Morocco and came into force in 2006 after completing the necessary requirements. The provisions of the Agadir Agreement request a removal of tariffs on all industrial and agricultural goods. As pertains anti-dumping, safeguards and the elimination of non-tariff barriers, the Agadir Agreement refers to the GAFTA provisions and WTO principles [14], [15]. The Agadir agreement is meant to promote trade integration by creating a free trade zone among Middle Eastern and North African countries and then linking the region to the EU. Therefore, the Agadir agreement is open for further memberships to all GAFTA members that are associated with the EU through bilateral agreements or EMAs.

3. Analysis of Euro-Mediterranean integrated policies

Besides the challenges and the context of the Euro-Mediterranean integrated policies, such as the Agadir agreement, several studies have attempted to assess and analyze the effects of the aforementioned political initiations on agro-food trade in the Mediterranean area. Such as Marquez-Ramos and Martinez-Gomez (2016) [16] that highlighted the positive effect of trade preferences granted by the EU to the fruit and vegetables exports from Morocco or Garcia-Alvarez-Coque et. al (2009) [17] that assessed the positive effect of bilateral trade liberalization on both sides (EU and Mediterranean countries) for the tomato market. Furthermore, Mulazzani and Malorgio (2009) [18] studied the trade patterns among EU countries and Mediterranean countries confirming the existence of specific relationships among specific countries while Galati et al. (2013) [19] who studied Italian agro-food exports to the Mediterranean region highlighted the positive effect of various factors (such as historical ties or geographical proximity) to the volume of trade. Finally, Scarpato and Simeone (2013) [20], assessed the evolvement of competitiveness for specific regions in Italy vis-à-vis agro-food exports in the Mediterranean region after their liberalization.

Following the relevant literature, this study, after 10 years of the Agadir agreement entry into force (2007-2016), attempts to assess the agriculture trade integration among countries signed under the agreement, namely Morocco, Tunisia, Egypt and Jordan, to determine to which extent Agadir members have accomplished the goals of the agreement and whether they succeeded in eliminating the hub and spoke effect. The paper is structured as follows: the next section introduces an overview of the agriculture sector of Agadir members and its trade characteristics in the extent of the Agadir-EU partnership. Section three includes the methodology of the work by presenting the three trade indices: Regional Hirschman, Sectorial Hirschman and the Trade Complementarity Index, using the twenty-four agricultural sectors’ classification (CN codes 01-24). Section four discusses the results concluded from the available agricultural trade data for the period 2007-2016. Finally, Section five concludes and highlights the limitations and challenges that hinder agricultural trade integration among Agadir-EU partners.

4. Agriculture policy and agricultural trade of Agadir members

Southern and Eastern Mediterranean countries (SEMCs) are facing serious challenges as pertains the development of agricultural and rural areas. According to the statement following the meeting of the CIHEAM Ministers of Agriculture held in Malta in 2012, «Current food consumption and production patterns are not sustainable in the Mediterranean basin due to biodiversity loss, degradation of natural resources, pesticide contamination, climate change, high energy and water consumption, dietary patterns and changes in eating habits, and high dependency on imports, as well as poverty and vulnerability of many rural and urban Mediterranean communities…» [21]. The agricultural situation varies a lot among these countries and yet there are more or less similar common challenges that they face. Rural poverty and inequality between rural and urban area remain major issues in all SEMCs, which eventually hinder the development of agriculture and rural areas. Among Agadir members, Egypt has the highest rate of poverty. According to the World Bank, rural poverty is three times higher than in the urban areas and around 80 percent of the extremely poor inhabit Upper Egypt, which includes half of Egypt’s population. The situation in Tunisia is less acute than most other members; however poverty is mainly concentrated in urban areas, accounting for 75 percent of the poor population. In all Agadir members, public policy makers are facing the same dilemma for decades: keeping prices of food as low as possible in order to protect the poor in contrast with the numerous farmers who are in most cases poor and their returns are extremely affected by low prices. Deteriorating natural resources is also an important issue. The poor rural population cannot afford the investments to build a sustainable management of resources. The increasing pressure on soil and misuses of water aggravate the agricultural situation in these countries, which are already characterized by the dry climate and low precipitation. Another important challenge facing Agadir members is the high dependency on imports. The provision of basic and strategic agro-food products depends heavily on outside suppliers. These products, which are merely a few commodities like cereals, sugar, oil and dairy products, have an enormous importance in the diet of the population, particularly the poorest. Rastoin et al. (2012) [22] claimed, in their proposal for a new Euro-Mediterranean agricultural and food policy, that in 2008, the agro-food import bill of SEMCs was three times as much as in 2000, leading to increasing food insecurity.

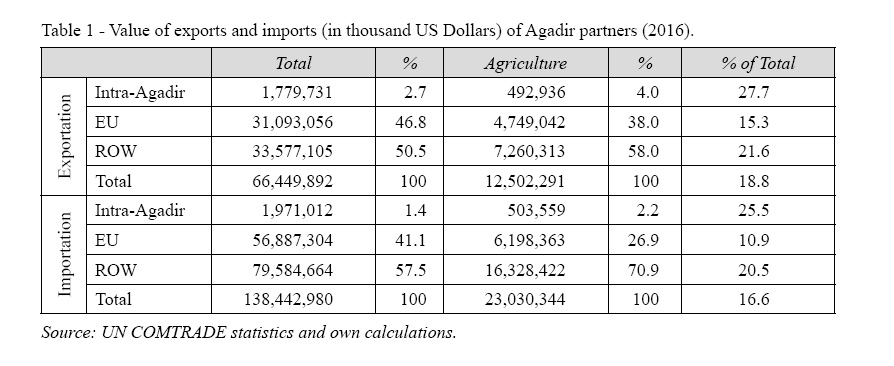

To give an idea of agricultural trade of Agadir countries, the following Table 1 displays the value of exports and imports of Agadir members in the extent of intra-Agadir, EU and the rest of the world, and the contribution of agriculture in the overall trade.

As presented on Table 1, the overall agricultural trade consists an important aspect of Agadir members in international trade, with 18.8 percent of exports and 16.6 percent of imports in 2016. It has to be noted that agricultural exports have risen significantly with an average annual growth of 9.3 percent during the period 2007-2016. Agricultural flows are even more important for intra-Agadir trade since almost a quarter intra-Agadir exports and imports are of agricultural nature (27.7 percent and 25.5 percent respectively). Nevertheless, the most important partner for Agadir members’ agricultural exports and imports is EU. 38 percent of total agricultural exports are shipped towards EU states while 26.9 percent of Agadir’s imports come from EU countries. The intra-Agadir flows are far less important comparing to the ones with EU members, with only 4 percent of total exports and 2.2 percent of total imports.

5. Methodology

In this current work, using the available agricultural trade data for the period 2007-2016 and the twenty four agricultural sectors’ classification (CN codes 01-24), three indices will be constructed utilizing agricultural imports and exports data from the four Agadir members (Morocco, Tunisia, Egypt and Jordan) and the 28 members of the European Union. The indices are as follows: Regional Hirschman, Sectorial Hirschman and the Trade Complementarity Index.

The Hirschman Index (Sectoral or Regional) is a widespread statistical tool to measure concentration. It is better known as the Herfindahl-Hirschman index since it owes its name to the two economists who built it up independently. Actually, Albert O. Hirschman introduced the HHI in 1945 in his work National Power and the Structure of Foreign Trade [23] followed by Orris C. Herfindahl who presented it in his unpublished doctoral dissertation at Columbia University Concentration in the U.S. Steel Industry [23].

The HHI has been used in a wide set of contexts and applied in various types of economic phenomena. Rhodes (1993) [24], in a technical note of the Federal Reserve Bank, demonstrated how the index can be employed to inspect the competitive effects of bank mergers. It has also been used in the field of the food processing industry [25], civil aviation [26] and the newspaper industry [27]. Regarding the scopes of trade and liberalization, the index has been used in a lot of international trade literature (e.g. Sadequl, 2001[28]; Ludema and Mayda, 2010 [29]) and, like this current work, it can be used to measure spatial or sectorial concentration of export flows (e.g De Castro, 2012 [30]; Natos et al., 2014 [31]). With the help of the United Nations “Handbook of Commonly used Trade Indices and Indicators” [32], we will construct the aforementioned indices as follows:

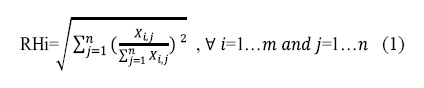

– Regional Hirschman index (RHi):

where X denotes the value of agricultural exports among countries i and j for the period 2007-2016, when i accounts for the four investigated Agadir countries, namely, Morocco, Tunisia, Egypt and Jordan and j accounts for the EU and Agadir countries.

The Regional Hirschman index (RHi) is a measure of the geographical concentration of exports. It takes a value between 0 and 1, with 1 signaling an absolute dependence of one country’s exports to one nation. In other words, it tells you the degree of one country’s exports dispersion across different destinations. High degrees of RHi means that the spatial concentration of one nation’s exports is exposed to fewer exporting markets, and in turn, it indicates the vulnerability to economic changes of these few markets.

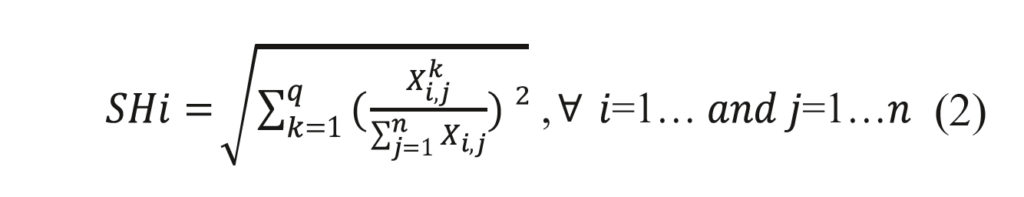

– Sectorial Hirschman index (SHi):

where X denotes the value of agricultural exports for each investigated sector k, for the period 2007-2016, among countries i and j where k accounts for the 24 sectors of the Combined Nomenclature-CN, as laid down by the Council Regulation (EEC) No 2658/87 that classifies agricultural products to the sectors 01-24.

Regarding the Sectorial Hirschman index, according to the Handbook of Commonly Used Trade Indices and Indicators, it measures the sectorial diversification or concentration of a country’s exports. It takes a value between 0 and 1, with 1 signaling an absolute dependence of a country’s exports to only one sector. High degrees of SHi indicate a significant sectorial concentration of a county’s exports with few economic activities sequentially signaling a vulnerability to the economic changes of these particular economic activities. Over time, decreases in the Sectorial Hirschman index may be used to prove the dispersion of the export sectors.

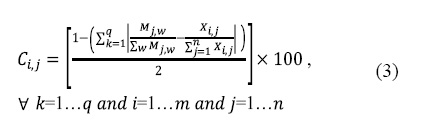

– Complementarity Index (Ci):

where M denotes the total value of agricultural imports, for each investigated sector k, for 2007 and 2016, among countries j and the world, while X denotes the value of agricultural exports among countries i and the world for 2007 and 2016, where i accounts for the four investigated Agadir countries, namely, Morocco, Tunisia, Egypt and Jordan and j accounts for the EU and Agadir countries.

Apart from the concentration indices detailed above, another useful index is Michaely’s bilateral trade complementarity index, or Ci [33]. It measures the extent to which two countries are “natural trading partners” by calculating the adequacy of one country’s export to supply another country’s import demand [34].

In fact, Ci is a type of overlap index. It takes a value between 0 and 100, with zero indicating no overlap and 100 indicating a perfect match in the import/export pattern. A high degree of complementarity index is supposed to indicate more favorable potential for a successful trade arrangement and changes over time may reveal whether the trade profiles are becoming more or less compatible.

6. Results

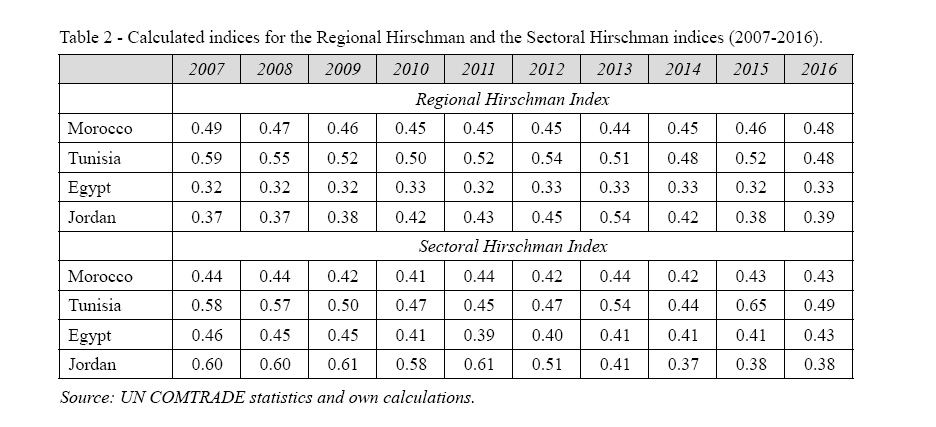

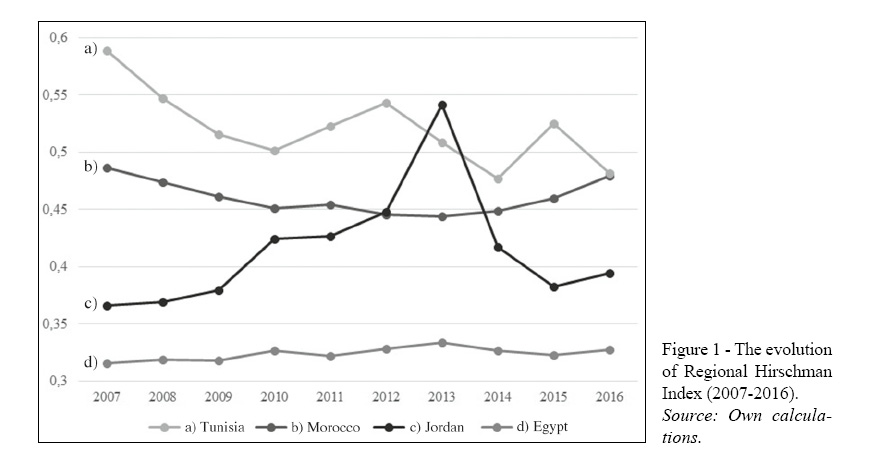

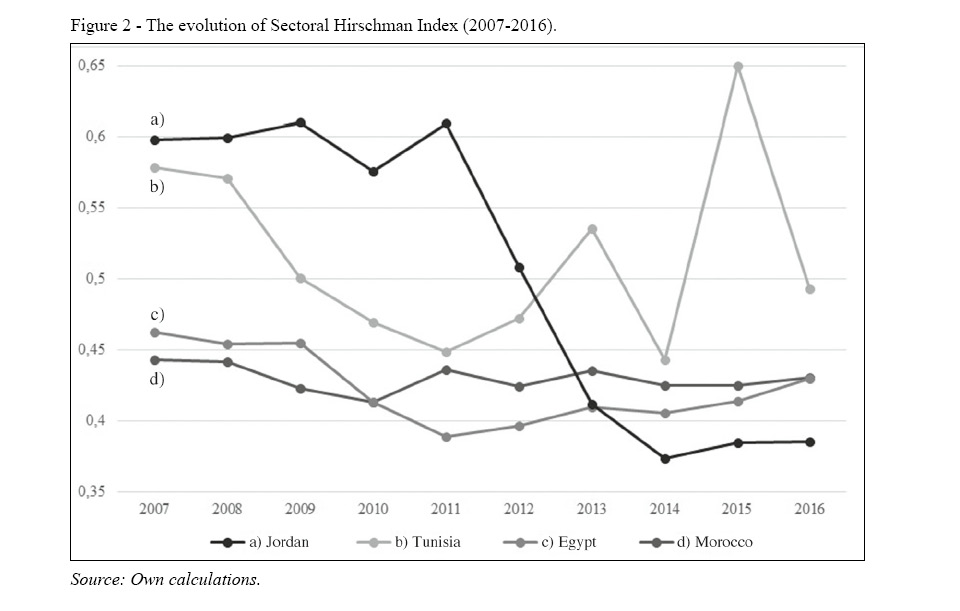

The data collected from the trade flows of the four countries investigated, namely Morocco, Tunisia, Egypt and Jordan, with their EU-28 partner countries allows us to build the three trade indices for the period 2007-2016 that we discussed in the previous section. Table 2 presents the first two trade indices; the Regional Hirschman (RHi) and the Sectorial Hirschman index (SHi), while Table 3 presents the last trade index, the Complementarity index (Ci) in 2016.

Concerning the Regional Hirschman (RHi) shown in Table 2, the overall calculation displays an improvement in the geographical dispersion of agricultural exports of only Morocco and Tunisia, especially for latter that has the highest rate of improvement. Its RHi dropped from 0.58 in 2007 to 0.48 in 2016. However, the other investigated countries, Egypt and Jordan, didn’t improve their geographical dispersion as RHi appears to increase during the period 2007-2016. In fact, Jordan’s RHi had grown from 0.36 in 2007 to 0.54 in 2013 but after that it decreased to reach 0.39 in 2016, while Egypt kept its RHi stable during 2007-2016 with some minor discrepancies. Yet, even Egypt and Jordan appear to have the least improvement in the regional diaspora of its agricultural exports for the period 2007-2016; they are calculated with the smallest regional concentration: 0.39 and 0.32 respectively in 2016, proving that they present the greater geographical distribution of their agricultural exports to the Agadir and EU members compared to the other investigated countries. The countries that show the least regional concentration of their agricultural exports are Morocco and Tunisia, 0.47 and 0.48 respectively.

Actually, Egypt’s top three agricultural exports partners (Jordan, Italy and UK) account for 44 percent of the total Egyptian agricultural exports while the share of Jordan’s top agricultural export partner (Germany, UK and Egypt) is 61 percent of the total. On the other hand, the share of the top three agricultural export markets of Morocco (Spain, France and Netherlands) is 73.3 percent of the total while for Tunisia (Italy, Spain and France) it is 74 percent. Thus, it is proof that Morocco and Tunisia are relatively reliant on a small number of export partners, which may make them exposed to the economic conditions of the specific countries, while Egypt and Jordan are relatively less exposed to the risk of the economic conditions of their exporting partners since they maintain a diverse group of agricultural exporting partners.

Regarding the Sectorial Hirschman Index (SHi), the calculation shows that there are no significant differences among the investigated countries. Jordan has the smallest SHi at 0.38 in 2016, which means that it has a relatively greater sectorial diversified synthesis of agricultural exports. Compared to the other countries, 0.42, 0.43 and 0.49 are respectively the sectorial indices of Egypt, Morocco and Tunisia, which is to say that these countries are the least sectorial diversified when it comes to agricultural exports. The latter results are also supported by the fact that the top three agricultural export sectors of these countries are counting respectively 67, 69 and 77 percent of the total which means that they are relatively heavily reliant on a small number of agricultural products to export, and are subsequently more vulnerable to the economic conditions to those specific agricultural sectors.

However, Jordan’s top three agricultural sectors (CN-7 Edible vegetables, CN-21 Miscellaneous edible preparations and CN-24 Tobacco) count for 59 percent of total agricultural exports which implicates less vulnerability towards the economic condition of these sectors compared to the other investigated countries, but it is still a high percentage which Jordan needs to work on. But taken as a whole, all the four investigated countries have displayed an improvement in their sectorial distribution of agricultural exports in the period 2007-2016. Jordan again has the greater decrease in its SHi by 35 percent, from 0.59 in 2007 to 0.38 in 2016, followed by Tunisia with a decrease of 14 percent, while Morocco and Egypt are noted with the lowest decrease of 2 percent and 7 percent respectively.

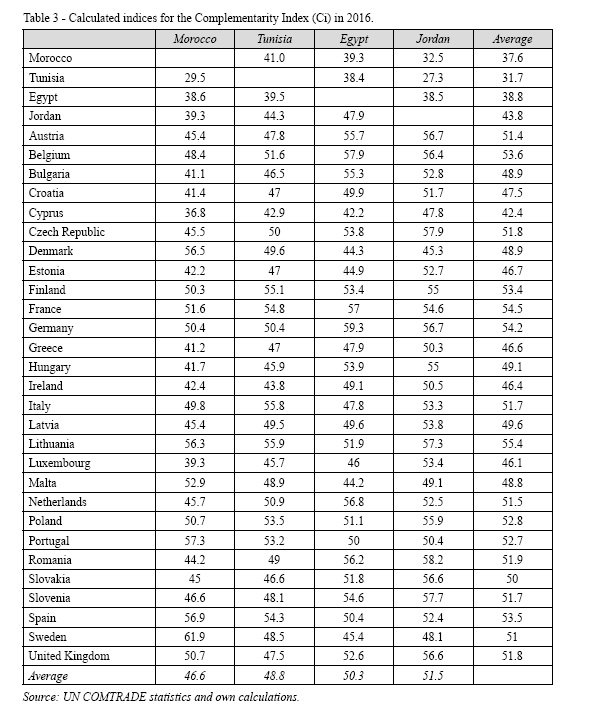

As pertains to the complementarity index (Ci), which measures the extent to which one country’s exports overlap with what the other country imports, Table 3 shows a certain level of compatibility among the investigated countries with Agadir and EU members in 2016. The leftmost column of the table shows the average complementarity index of Agadir members’ exports with respect to each EU-Agadir imports (EU-28 + 4 Agadir). The average complementarity of the exports of all investigated countries (Agadir Members) with the imports of the Agadir and EU countries is relatively noteworthy with most EU countries (from 42,4 in Cyprus to 55,4 in Lithuania), compared with the Intra-Agadir members (31.7 in Tunisia to 43.8 in Jordan). Among EU partners, the top five, as it regards its average compatibility with respect to the imported agricultural commodities of Agadir members, are Lithuania, France, Germany, Belgium and Finland, while Cyprus, Luxemburg, Ireland, Estonia and Greece are the less favorable partners as they display a relatively low Ci compared to the rest.

The assessment of each investigated country’s Ci with EU-Agadir members indicates a certain level of complementarity. In fact, all investigated countries are calculated with close averages of Ci from 46.6 in Morocco to 51.5 in Jordan, showing that there is a partial match of these countries’ agricultural exports with Agadir and Agadir-EU members’ agricultural imports. Individually, for each investigated Agadir country, Morocco’s agricultural exports are relatively compatible with Sweden, Portugal and Spain with indices of 61.9, 57.3 and 56.9 respectively, which indicates in turn that these are the most favorable exporting markets signaling positive prospects for future export expansion. However, Cyprus and Luxemburg are calculated with the smallest indices with 36.8 and 39.3, showing that there is a significant mismatch among Morocco’s exporting pattern and the aforementioned countries’ importing patterns which means that their prospects as potential exporting markets for the Moroccan agricultural products are relatively negative. For Tunisia, the top favorable partners in terms of trade complementarity are Lithuania, Italy, Finland and France as they display significant Ci (with indices of 55.9, 55.8, 55.1 and 54.8 respectively), signaling positive potential. In contrast, relatively smaller rates for the Ci index were calculated for Cyprus and Ireland. Hence, Tunisia’s agricultural exports supply is relatively inharmonious with the demand of agricultural imports of these two partners. It is worth mentioning that geographical proximity and history play a key role in building the trade complementarities of Tunisia and Morocco over time with its favorable partners. For example Morocco has a long history with its close European neighbors Spain and Portugal which implicates a strong trade relationship and a significant complementarity especially in terms of agricultural commodities (similar to Tunisia with its close trading partners of Italy and France). With respect to Egypt, high complementary indices are calculated with Germany, Belgium and France, with indices of 59.3, 57.9 and 57 respectively, displaying Egypt’s great potential as a future agricultural exporter with these countries. Nevertheless, on the other hand, Cyprus and Malta represent the most unsuitable partners when it comes to trade complementarity, with smaller indices 42.2 and 44.2. Finally, Jordan, the country among Agadir members with relatively more sizable complementarity indices (51.5 in 2016), exposes its greatest potential as an agricultural exporter with especially eastern European countries like Romania, Austria, Lithuania and Czech Republic with indices of 58.2, 56.7, 57.3 and 57.9 respectively. The UK with its significant complementarity index of 56.6 is also considered as a potential agricultural importer to Jordan’s agricultural goods. On the other hand, less favorable prospects were calculated again for Cyprus and Denmark, signaling a mismatch between Jordan’s agricultural exports and those agricultural imports partners.

Regarding the intra-Agadir bilateral agricultural trade, the complementarity indices appear to be less significant compared to those of the EU countries. The greater Ci is calculated for the Egyptian agricultural exports that partly matches Jordan’s agricultural imports with an index of 47.9. However, incompatibilities are relatively prevalent in almost all other bilateral agricultural trade, especially for Jordan’s agricultural exports with respect to Tunisia’s agricultural imports (27.3).

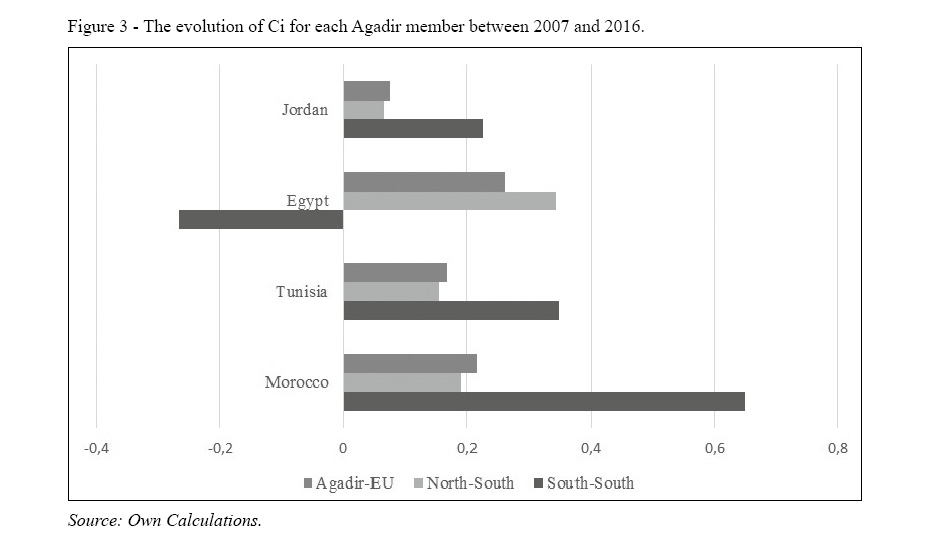

As pertains to the evolution of the Ci for the period 2007-2016 as shown in Table 3, it turns out that the Agadir members have improved their agricultural exports to match more closely with EU and Agadir imports. Morocco and Egypt are calculated with the greatest improvement (21.5 percent and 20.6 percent respectively) since 2007, followed by Tunisia and Jordan with 14.4 percent and 7 percent. In terms of intra-Agadir complementarities (South-South), all the investigated countries have improved their agricultural supply a lot to match the export supply of Agadir countries, except for Egypt. Morocco has the greatest growth of agricultural complementarity with 65 percent between 2007 and 2016, followed by Tunisia and Jordan with 35 percent and 22 percent respectively. However, Egyptian exports’ complementarity with respect to other Agadir members’ imports has decreased by 26 percent signaling a lower harmonious trade compatibility. Concerning the south-north trade complementarity, Agadir members’ agricultural exports have been more balanced with European imports since 2007. Egypt has registered the greatest growth with 34 percent, succeeded by Morocco, Tunisia and Jordan respectively. Nevertheless, it is worth mentioning that the evolution of intra-Agadir complementarity (south-south) has been far greater than Agadir with EU (north-south) complementarity (except for Egypt) as seen in Figure 3.

7. Conclusions

Since the Barcelona declaration, the Euro-Mediterranean partnership has witnessed many improvements in terms of trade liberalization. However, agricultural flows remain lagged compared to the remaining exchanged commodities. The non-tariff barriers established by EU countries have complicated the prosperity of agricultural exports of southern and eastern Mediterranean countries. The verticalization of trade relations between the two Mediterranean shores gave rise to the hub and spoke effect, which also plays a significant role in hindering southern exports since Mediterranean firms and private investors have no incentive to set themselves up in the spokes and prefer to function in the EU and eventually have easy access to all the spokes in the Mediterranean basin. It wasn’t until the 4th EuroMed conference of foreign ministers in 2000 that all partners realized supporting south-south integration would become inevitable. Therefore, the Agadir agreement was intended to push forward south-south integration in a step to eliminate the hub and spoke effect and release intra-regional investments. The present study focuses on the evaluation of geographical and sectoral dispersion of Agadir members’ agricultural exports as well as complementarity with the agricultural importing markets of the EU and intra-Agadir members. Accordingly, by calculating the three indices during 2007-2016, that is to say the Regional Hirschman (RHi), Sectoral Hirschman (SHi) and Complementarity (Ci) index, the current work points to the existence of improvements with regards to the geographical and sectorial dispersion of agricultural exports of Agadir members, with significant irregular rises and falls. Regarding complementarity, Agadir members have succeeded to develop their agricultural exports to better match EU imports during 2007-2016, particularly Egypt. In the context of intra-Agadir (South-South), the investigated countries’ exports have likewise accomplished an improvement in better matching the imports of the rest of the members, and the growth rate of the complementarity has been more significant than with that of the EU members, expect Egypt which has a negative evolution. In this regard, it should be noted that the improvements made during 2007-2016 are astonishing regardless of the agricultural weaknesses and political instabilities in the region. Yet, the intra-Agadir (South-South) complementarity is still small compared to Agadir-EU (North-South). Thus, the overall results of the present work prove that, despite the progress made in flourishing agricultural exports geographically and sectorally, as well as in terms of complementarity, south-south agricultural integration is not yet as equal as south-north integration and the “hub and spoke” effect is still persisting. After all, the EU support to flourish south-south integration trade integration is not enough. The existence of a serious internal problems have certainly lagged the trade integration. Therefore, a harmonized south policy is inescapable to deeper the overall trade integration and agricultural trade integration in particular, since it takes a big part of the flows. In 2016, Lebanon and Palestine joined the agreement and their membership was approved during the third meeting for Agadir, giving them access to the Jordanian, Egyptian, Moroccan and Tunisian markets. Hence, south-south integration has been revived by including more south-eastern Mediterranean countries and perhaps the path towards a free trade Euro-Mediterranean zone is getting shorter.

Acknowledgment

We are grateful to all of those with whom we have had the pleasure to work during this paper. We are also immensely grateful to our parents and friends for supporting us to keep working and give our best.

References

- Stiglitz J.E., 1998. Towards a new paradigm for development, United Nations conference on trade and development, Geneva.

- Fischer S., 2000. Lunch Address Given at the Conference on ‘Promoting Dialogue: Global Challenges and Global Institutions’, American University, Washington, DC.

- OECD, 1998. Open Markets Matter: The Benefits of Trade and Investment Liberalisation, Paris.

- Union for the Mediterranean, 2018. Ministerial Declaration of the Union for the Mediterranean (UfM) Trade Ministers, Brussels. Available from: http://trade.ec.europa.eu/doclib/docs/2018/april/tradoc_156717.pdf.

- Osswald E., Wolfgang W., 1982. European Concepts for the Mediterranean Region. The International Spectator, Vol. 17, No. 4 (October-December): 283-306.

- Tsoukalis L., 1977. The EEC and the Mediterranean: Is ‘Global’ Policy a Misnomer? International Affairs, Vol. 53, No. 3 (July): 422-438.

- Cardwell P.J., 2011. EuroMed, European Neighbourhood Policy and the Union for the Mediterranean: Overlapping Policy Frames in the EU’s Governance of the Mediterranean. JCMS: Journal of Common Market Studies, 49: 219-241. doi:10.1111/j.1468-5965.2010.02119.x

- Barcelona Conference, 1995. Barcelona declaration adopted at the Euro-Mediterranean Conference, Barcelona. Available at: http://www.eeas.europa.eu/archives/docs/euromed/docs/bd_en.pdf.

- European Institute of the Mediterranean, 2015. 20th anniversary of the Barcelona Process. Available

at: https://www.iemed.org/actualitat-en/noticies/20e-

aniversari-del-proces-de-barcelona#immens. - Togan S., 1998. The EU–Turkey, EU–Tunisia and EU–Israel Trade Agreements: a comparative analysis. Paper presented at the Second Mediterranean Development Forum “Economic Development and Poverty Reduction”, Marrakesh, 3-6 September 1998, http://www.worldbank.org/mdf/mdf2/papers/benefit/trade/togan.pdf.

- García-Alvarez-Coque, J., 2002. Agricultural trade and the Barcelona Process: is full liberalisation possible?, European Review of Agricultural Economics, Vol. 29, Issue 3, 1 August 2002: 399-422, https://doi.org/10.1093/eurrag/29.3.399.

- Baert T., 2003. The Euro-Mediterranean agreements. In: Sampson G.P., Woolcock S. (eds.), Regionalism, Multilateralism, and Economic Integration – The Recent Experience, pp. 100-134. Tokyo and New York: United Nations University Press.

- M’barek R., Wobst P., Lutzeyer H.-J., 2006. Euro-Med Association agreements: Agricultural trade-regional impacts in the EU. Workshop proceeding PB/2006/IPTS/3548. Institute of Prospective Technological Studies, European Commission, Seville.

- Agadir Agreement, 2005. Agadir Agreement–Agreement establishing a Free Trade Area between Arab Mediterranean Countries, published online 17.

- Layadi A., 2008. Die interarabische Wirtschaftsintegration. Nomos Universitätsschriften Politik”, Band 154. Baden-Baden: Nomos Verlagsgesellschaft.

- Márquez-Ramos L., Martinez-Gomez V., 2016. On the effect of EU trade preferences: Evidence for monthly exports of fruit and vegetables from Morocco. New Medit, 15: 2-13.

- García-Alvarez-Coque J.M., Martinez-Gomez V., Villanueva M., 2009. A trade model to evaluate the impact of trade liberalisation on EU tomato imports. Spanish Journal of Agricultural Research, 7: 235-247.

- Mulazzani L., Malorgio G., 2009. Market dynamics and commercial flows in the Mediterranean area: Triangular effects among the EU, the MPCs and Italy in the fruit and vegetable sector. New Medit, 8: 37-45.

- Galati A., Crescimanno M., Yahiaoui D., 2013. Determinants of Italian agri-food exports in non-EU Mediterranean Partner Countries: An empirical investigation through a gravity model approach. New Medit, 12: 46-54.

- Scarpato D., Simeone M., 2013. Euro-Mediterranean integration and competitiveness of the agro-food sector. An empirical analysis in Campania region. New Medit, 3: 56-64.

- FAO/CIHEAM, 2012. Towards the Development of Guidelines for Improving the Sustainability of Diets and Food Consumption Patterns in the Mediterranean Area, Rome. Available at: http://www.fao.org/docrep/016/ap101e/ap101e.pdf.

- Rastoin J.-L., Bourgeois L., Cheriet F., Mohavedi N., 2012. Pour une politique agricole et agroalimentaire euro-méditerranéenne. Paris, IPEMED, http://www.ipemed.coop/fr/-r17/-c49/-a1494.html.

- Herfindahl O.C., 1950. Concentration in the US steel industry. Unpublished PhD. Dissertation, Columbia University.

- Rhodes S.A., 1993. The Herfindahl-Hirschman index. Federal Reserve Bulletin, 79: 188-189.

- Lopez R., Azzam A., Lirn-Espaa C., 2002. Market Power and/or Efficiency: A Structural Approach. Review of Industrial Organization, 20(2): 115-126.

- Lijesen M.G., Nijkamp P., Rietveld P., 2002. Measuring competition in civil aviation. Journal of Air Transport Management, 8(3): 189-197.

- van Kranenburg H., 2002. Mobility and Market Structure in the Dutch Daily Newspaper Market Segments. Journal of Media Economics, 15(2): 107-123.

- Sadequl I., 2001. Concentration of International Trade in High-Technology Products. Applied Economics Letters, 8(2): 95-97.

- Ludema R.D., Mayda A.M., 2010. Do Terms-of-Trade Effects Matter for Trade Agreements? Evidence from WTO Countries, C.E.P.R. Discussion Papers.

- De Castro T., 2012. Trade Cooperation Indicators: Development of BRIC Bilateral Trade Flows, International Review of Business Research Papers, Vol. 8, No. 1: 211-223.

- Natos D., Staboulis C., Tsakiridou E., 2014. Agricultural Trade Integration in Western Balkans: Orientation and Complementarity. Agricultural Economics Review, 15(2): 85.

- Mikic M., Gilbert J., 2009. Trade Statistics in Policymaking. A Handbook of Commonly Used Trade Indices and Indicators – Revised Edition. New York: United Nations Publications.

- Michaely M., 1996. Trade preferential agreements in Latin America: an ex ante assessment, Policy Research Working Paper 1583, Washington D.C.: The World Bank.

- UNCTAD-WTO, 2012. A practical guide to trade policy analysis, United Nations Conference on Trade and Development and World Trade Organisation.