Abstract

The objective of this study was to determine the factors affecting urban land prices in Atakum district of Samsun province, Turkey. Agricultural lands in Atakum changed to urban lands especially within the last 20 years due to increasing population and public facilities such as; roads, tram line, schools, etc. Data used in this study were collected in questionnaires on 64 land parcels sold by real estate agents in 2017. The factors affecting urban land prices were determined with Hedonic Price Analysis. The significance of model parameters was tested, and the variability of land prices was verified for the hypothesized relationships between the significant parameters and the parcel price. The significant factors affecting urban land price were distance to coast, floor area ratio, parcel size, parcel shape, distance to tram station, post office and bus station.

DOI: 10.30682/nm1904f

Osman Kilic*, Ugur Baser*, Coskun Gulser*

* Faculty of Agriculture, Ondokuz Mayis University, Samsun-Turkey.

Corresponding author: okilic@omu.edu.tr

Cite this Item: Kilic O., Baser U., Gulser C., Factors explaining urban land value variability: a case study in Atakum District, Samsun-Turkey, New Medit, 18 (4): pp. 79-88, http://dx.doi.10.30682/nm1904f

1. Introduction

Besides changing the basic needs of people migrating to newly constructed neighborhoods in big cities, urbanization puts high pressure on agricultural lands, leading to sharp increases in urban land values. Samsun province, which is an essential agricultural center in the Black Sea Region of Turkey, continues its municipal and industrial development even using top quality and highly fertile agricultural lands. As a natural result of urbanization, a dramatic decrease in agrarian lands is inevitable. On the other hand, infrastructure and superstructure services such as new trade areas, residential areas, social facilities, and transportation services are being realized.

Migration movements cause rapid urbanization. Although migration is a movement of changing the location of people, it is a multi-dimensional movement that affects not only people but the social and economic structure in the place they migrate. People migrate to more attractive cities for commercial, educational, and other social reasons by abandoning their original areas of residencies. The fact that the services provided in cities cannot be provided in proportion to the speed of urbanization results in distorted and unhealthy urbanization. The sudden and uneven increase of urbanization leads to issues such as insufficiency of services and lack of adequate and timely developed urban organizations. With the rapid urbanization, housing deficits gradually increase, and people lead to squatter around urban centers to meet their housing needs. As many problems remain unsolved, the contemporary urbanization criteria cannot be achieved. Started in the 1950s, urbanization problems in Turkey caused by rapid migration from villages to large cities, gained tremendous momentum in recent years has become a significant problem. The economic and populist policies that lead to rapid urbanization have fueled distorted urbanization and hence the need for housing. A research conducted in Albania concluded that agricultural policies should focus on farm productivity and economic diversification in the rural areas in order to prevent rapid urbanization and its problems (Guri et al., 2016).

Atakum is one of the new districts administratively connected to Samsun province and continuously enlarging its urban borders on the opposite of farmlands. Since there is no restricted law and regulations to protect farmland against urbanizations, landlords cannot resist to high-level price offers, and therefore sell their lands to be used for urbanization. Rapid urbanization has caused many changes in Atakum district. The tram transportation system which entered service in 2010 starts from the center of Samsun and passes through the district of Atakum and serves to the university (Samulas, 2018). In recent years, developments such as multi-stored buildings and shopping centers along the tram route, proximity to a state university with more than 50 thousand students (OMU, 2018), and a fascinating sea view attract more investors to come to this district.

Land values indicate the market value that people ascribe to specific places. These values are affected by demand factors, such as views, amenities, and proximity to employment opportunities and transport infrastructure. Modern studies of the impacts of agglomeration in urban centers and of the value of the provision of new infrastructure use land values to estimate the benefits of a particular infrastructure project and additional benefits resulting from proximity to other firms, markets, and workers (Grimes and Liang, 2007).

Rapid population growth in Turkey drives demand for housing and has dramatically increased real estate activity. Real estate values should be evaluated according to scientific and objective criteria. The accurate appraisal of real estate values, especially in executing public proceedings, is particularly critical (Karakayaci, 2011).

There is a suite of factors affecting urban land prices that are based on the economic, social and demographic structure of the population, infrastructure and economic activity in the region, and expectations of the future. Determining the degree of influence of the various factors affecting land prices helps to interpret land prices and differences among prices objectively. This is essential for land appraisal, expropriation, customization, land reform, estimating taxes, capital marketing, insurance and banking (Cakir and Sesli, 2013).

The importance of land parcel characteristics has been noted in many previous studies. The size of the nearest settlement and the local population influence land prices (Forster, 2006; Guiling et al., 2009). Naydenov (2009) reported that there is a significant negative relationship between distance to the capital city and land prices in Bulgaria and that the distance of a parcel from the seaside was relevant. Stewart and Libby (1998) emphasized that besides proximity to a metropolitan area, land prices are influenced by the quality of the infrastructure and accessibility, especially proximity to a highway or a state road. Sklenicka et al. (2013) studied the factors affecting farmland prices in the Czech Republic. They reported that the most potent factor in explaining the sale price per square meter of farmland was proximity to a settlement and significantly higher prices were realized close to existing built-up areas. This factor was followed by the population of the municipality, travel time to the capital city, accessibility of the parcel and natural soil fertility. In order to figure out agricultural land prices, the spatial effect was also studied by researchers. Kostov (2009) investigated agricultural land prices in Northern Ireland by employing a spatial quantile regression hedonic model.

Similarly, research conducted in Japan and Northern Island found that spatial characteristics influence land prices (Pa´ez et al., 2001; Patton and McErlean, 2003). Beside agricultural lands, the spatial effect also affects urban land use. Braimoh and Onishi (2007) investigated the spatial effect on urban areas in Nigeria and found that the most critical factors related to urban land use are accessibility, neighborhood, interactions, and spatial policy.

Haas (1922) used the concept of “hedonics”, and created a simple hedonic pricing model for farmland, with the city size and distance to the city center as the two most important variables. Wallace (1926) and Waugh (1928) also used the hedonic price method for studying farmland and vegetable prices. Court (1939) adopted the term “hedonic” for automobile pricing as a function of the automobile’s different characteristics and carried out the hedonic price analysis of heterogeneous consumer goods (Goodman, 1998). Lancaster (1966) first put forward a new consumer theory that analyzed the fundamental “element” forming the product, and argued that the demand for the product was not based on the product itself, but its characteristics. Heterogeneous goods have a clutch of integrated features and are difficult to analyze with the traditional economic model because they cannot be seen in a single total price. Therefore, a series of prices to express the corresponding product characteristics is made up of hedonic prices, with each product characteristic having its own implied price, with all hedonic prices forming a price structure. Rosen (1974) theoretically analyzed the long and short term equilibrium of the heterogeneous product market and established the modeling foundation for the hedonic price theory. It is based on the econometric method that can be used to estimate the hedonic price function, get implicit prices of product characteristics, and then analyze the demand for product characteristics. Wen et al., (2005) applied hedonic price analysis to urban housing in Hangzhou, China. They chose 18 characteristics under the umbrella of the structure type, neighborhood, location, and subclasses as independent variables and developed a linear hedonic price model for Hangzhou City. They reported that 14 of 18 characteristics had a significant influence on housing prices, with the following list arranged from most to least influential: floor area, distance to West Lake, inner environment, distance to central business district, traffic conditions, garage, attic, internal fittings, environment, community management, apartment level, entertainment facilities, transaction time and proximity to a university. Forster (2006) reported a higher level of conversion of farmland to residential and commercial use in areas where population growth is occurring.

Atakum district, with a population of 181,302 in 2016, had the highest population growth (6.7%) among the districts of Samsun city in the middle Black Sea Region of Turkey (TUIK, 2018). Collectively, population growth and migration have increased the demand for residential and commercial properties in Atakum district in recent years. In parallel, urban land prices have increased due to the demands on the limited total area suitable for development. For these reasons, the objective of this study was to determine the factors affecting urban land price and to develop a model for predicting land price in Atakum district.

2. Material and Methods

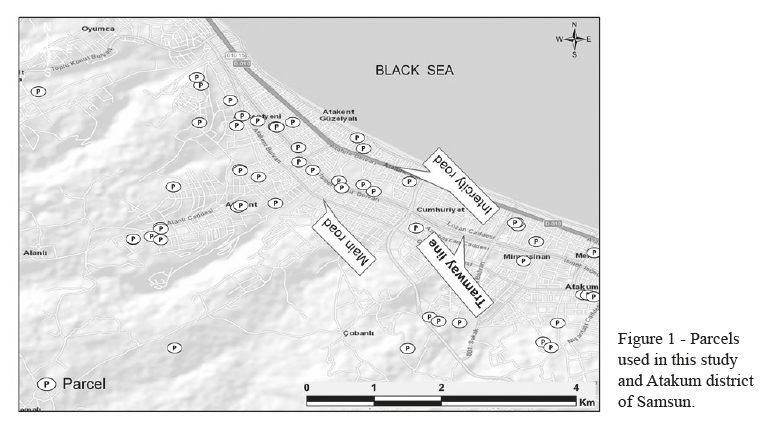

According to the records of Atakum Municipality, land parcel sales in Atakum district increased in recent years. The primary material in the current research was the data obtained from questionnaires completed by nine real estate offices on 64 parcels sold in Atakum. These parcels will not be used as agricultural land in the future and available to construct buildings to meet the housing needs of rapid urbanization. Also, data obtained from the Department of Land Registry in Atakum Municipality was used in the study. A satellite image of the general location of the 64 land parcels used in this study is given in Figure 1.

Although value estimation for intangible goods such as recreational areas and national parks is mostly conducted by the Travel Cost Approach (Abichou and Zaibet, 2008), in this study, the effects of land characteristics on land prices were estimated with the hedonic price model, using to the least squares method. In the model, the Kolmogorov-Smirnov test was used for the assumption for normality, and the variance inflation factor (VIF) values were examined for the potential a multicollinearity problem. The data used in the study showed normal distribution, and there were not multiple linearity problems. Furthermore, if the variance of the error term is not the same for all observations, the varying variance problem (heteroscedasticity) may arise. The Breusch-Pagan, Harvey and Glejser tests were applied to determine the heteroscedasticity, and it was determined that there was not a variance problem. The t-test was used to assess the significance of the coefficients in the models, and the F test was applied to determine the joint significances of variables.

A land parcel is a heterogeneous entity that has a set of unique features that depend on its location. Many factors, including the social status and income levels of customers, affect decision making in the purchase of real estate. Each customer has a distinct set of priorities in deciding on a real estate purchase, e.g., while some buyers prefer a parcel close to coastline or a good physical environment with parks and green open space, others prefer a parcel close to schools. These preferences of buyers affect the value of real estate. Therefore, a model was established within the scope of this study by using land parcel price as the dependent variable and 19 other variables as independent variables. For the selection of the variables, firstly, the correlation matrix was used to determine the significance and highly correlated variables. Then, to overcome the multicollinearity problem in the regression model, the final variables were selected by looking at their VIF values. Those valued 10 and less were used in the regression model.

The linear model used in this study is given below:

P = α + β1x1 + β2x2 + …… βnxn + µi

Where P is parcel price, x1…xn are the variables defining parcel features, β1… βn are the coefficients of variables, and µ is the error term.

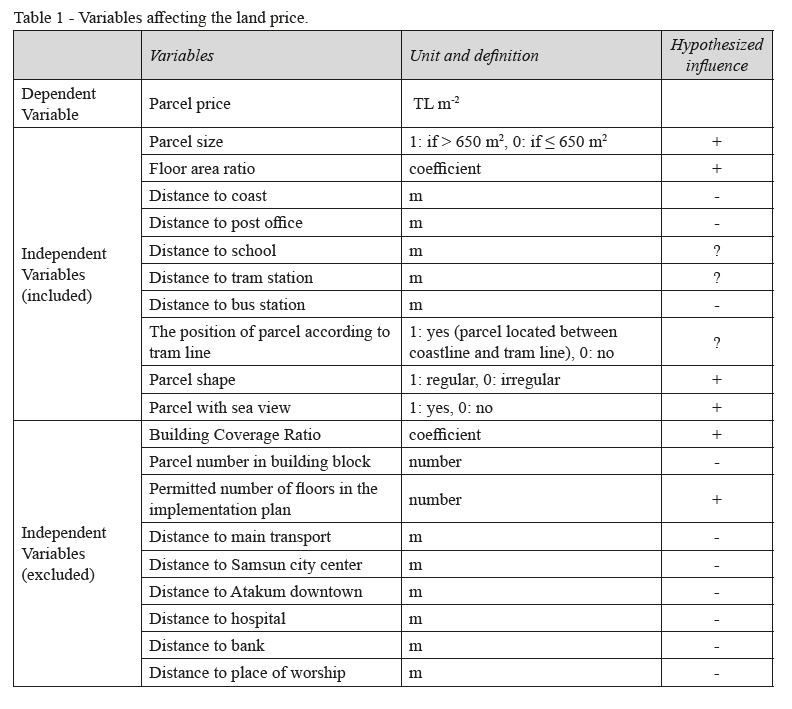

Logarithmic and semi-logarithmic models were also tested. It was determined that the linear model was the best fitting model for this study. The variables used in the model and their definitions are given in Table 1.

3. Results and Discussion

3.1. Parcel features

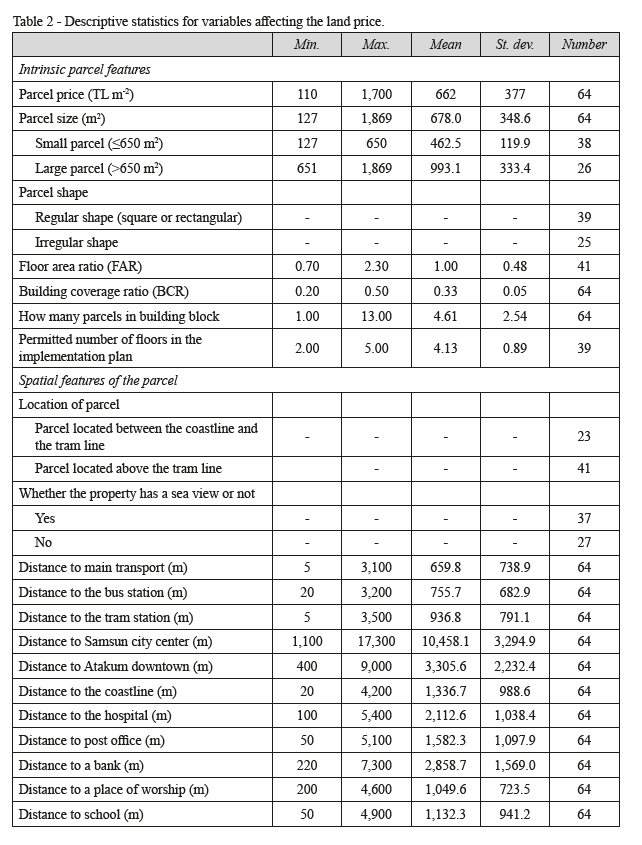

The parcels that were the subject of the current study exhibited many different intrinsic and spatial characteristics. The features of land parcels used in this study are given in Table 2. Bölen et al., (2009) reported that the land-use intensity measures that are generally used in urban planning in Turkey are the floor area ratio (FAR) and the building coverage ratio (BCR). The FAR defines the total floor area of the construction in the parcel, and the BCR is the floor area of the building divided by the parcel area. In the implementation plan for undeveloped areas, this value is calculated by multiplying the floor area coefficient stated in the plan or regulations by the number of flats. Bölen et al., (2009) studied randomly selected residential buildings on 150 streets representing all types of residential areas in Istanbul. They found that the floor area ratio used in urban planning to control land use intensity in Istanbul is between 1.00 and 3.00 and that the building coverage ratio in more than three-thirds of the residential areas is over 0.25. They concluded that Istanbul is a compact city and that the buildings are constructed very densely. In the current study, the mean floor area ratio was 1.4, and mean building coverage ratio was 0.33 in Atakum district.

3.2. Land Price Model Used in the Study

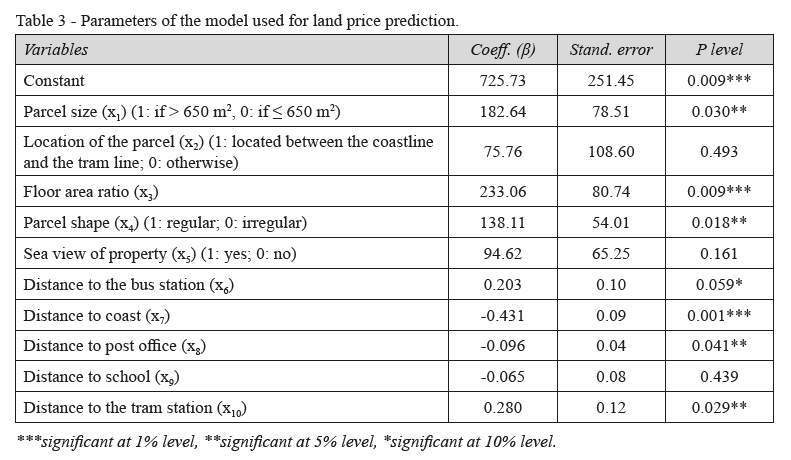

In the study, the land price (P) model created with an R2 value of 0.798 is given below (Table 3);

P = 725.73 + 182.64x1 + 75.76x2 + 233.06x3 + 138.11x4 + 94.62x5 + 0.203x6 – 0.431x7 – 0.09x8 – 0.06x9 + 0.28x10 + µi

where: x1; parcel size, x2; location of parcel, x3; floor area ratio, x4; parcel shape; x5; sea view property, x6; distance to bus station, x7; distance to coast, x8; distance to post office; x9; distance to school and x10; distance to tram station.

According to the R2 value, the price of a land parcel price is 79.8% predictable when using the model and the independent variables. The coefficients of variables in the model showed that the distance to coast and FAR were significant at 1% level; while the parcel size, parcel shape, distance to post office and tram station were significant at 5% level; and finally distance to bus station was significant at 10% level. The F value (8.70***) of the model showed that the parcel price was significantly predicted by the model (Table 3).

Regarding the physical location of the land parcel, the most significant factor affecting the parcel price was the distance to the coast. It was determined that the price of a parcel decreased as the distance to the coast increased. The unit price of the parcels located near the coast was generally higher than that of the other parcels. FAR was the second most significant factor affecting parcel price. This is the ratio determining construction size allowed to be built on a parcel. The model indicated that a 1 unit increases in FAR increased the parcel price by 233.06 TL per m2. The third significant factor was the distance to a tram station. It was expected that the price of a parcel increased as the distance to the tram station decreased. However, there was an exception that even though the distance from the tram station increased, land prices also increased due to reducing the distance to the coast (Figure 1).

The other important factor affecting the land price is the parcel size. The mean unit price of the parcels larger than 650 m2 was 182.64 TL higher than the price of parcels equal or smaller than 650 m2. It can be explained that the large parcels are more suitable for the construction of new buildings. The parcel shape was also a significant factor affecting land price. The usage of an irregular shaped parcel for construction is difficult. In the current study, the mean price of a regularly shaped parcel was 138.11 TL m-2 higher than the price of an irregular shaped parcel. The other significant features of the spatial environment of a parcel were the distance to the post office and bus station. As the distance of the parcel to the nearest post office and school increased, the parcel prices decreased (Table 3). Parcels located near a bus station were cheaper than parcels located far away from a bus station. Another critical factor affecting the parcel price was the position of parcel related with sea view. If a parcel had sea view, its unit price was 94.62 TL m-2 higher than the price of a parcel without sea view. The proximity of the parcel to the only existing tram which goes parallel to the coastline is shown in Figure 1. The mean price per m2 of a land parcel located between the shoreline and the tram line was 75.76 TL higher than that of a parcel located on the inland side of the tram line. The most critical determinant of pricing is that there is limited transportation to the settlement areas inland from the tram line and consequently there is less demand for the parcels in these areas. Also, the scarcity of parcels for development on the seaward side of the tram line increases the price difference between the inland and seaward sides of the tram line. Cosar and Engindeniz (2013) reported that it is possible to obtain objective results with Hedonic price analysis of land values by determining the factors affecting the value and incorporating them in the valuation process and to transfer the results to practice. In the present study, it seems quite reasonable to estimate the sale price of a parcel in Atakum district by employing a regression model using the data on the known parcel features.

4. Conclusions

The appraisal of real estate values is critical in the case of expropriation. The parcel price, according to expropriation law in Turkey, is determined by sales comparison approach. It is a process used to determine the current market value of a property based on recent sales of comparable properties in the area. The determination of factors affecting parcel price and their weightings is essential in land valuation. Currently, the pace of construction in Atakum district is being maintained at a high level, and determination of the factors affecting parcel prices and modeling land pricing can guide both public institutions and the private sector in the determination of appropriate land values. Rapid population increase and new public facilities (such as; roads, tram line, schools, etc.) made Atakum a new urban side of Samsun and agricultural lands changed to urban lands especially within the last two decades. In this study, factors affecting land parcel prices in Atakum district of Samsun province of Turkey were determined. Data related to 64 parcels were collected, and the weightings of the factors that determined the agreed/sale price were assessed with the hedonic regression technique. The significant factors affecting parcel prices in this study were the distance to coast, floor area ratio, parcel size, parcel shape, distance to tram station, post office and bus station.

Local governments and municipalities play the most active role in making a city healthy and attractive. They have to try to prevent individual land ownership from being used against the common purposes of the community. Atakum district, where the study was conducted, is one of the districts located on the shore of the Black Sea and has the highest coastal length. Due to rapid urbanization and vertical construction, the district population has dramatically increased in recent years. The rapid urbanization of the district has brought about many social and economic problems and has led to significant environmental issues such as marine pollution. The newly constructed tram line, which is on the shore of the district and parallel to the sea coast, has increased the land prices, especially on the coast. Applying low rate taxes on the sale and purchase of empty lands has made the sale and purchase of these estates speculative. It can be seen from the results of this survey, the sea and tram lines have a very high impact on land prices. Results of this study can be generalized to the similar developing urban areas, particularly in all residential areas of seashores. Hence, legal regulation is being made by the government on obtaining a higher tax on the purchase and sale of empty lands and buildings. With this law, it will be ensured that the sale of the real estate is not a speculative activity and the taxes will be collected from the actual values of the real estates. The data collection process was the biggest problem encountered when determining the factors affecting parcel prices. The sale prices of parcels were obtained from either real estate offices or the parcel owner. However, real estate offices and parcel owners were reluctant to reveal information due to some reasons such as the payment of land transfer tax. This added a degree of difficulty to the determination of the factors affecting parcel prices and their relative importance. The main limitation of the study was that it based on the information on land values provided from only one region. Additional studies using panel data would bring more valuable results to the issues raised. Also, future studies should focus on the effect of taxes on land prices.

Acknowledgments

The authors thank Gregory T. Sullivan of the University of Queensland in Brisbane, Australia for proofreading the English in an earlier version of this manuscript.

References

- Abichou H., Zaibet L., 2008. Evaluation de la valeur récréative du parc Ennahli (Tunis). New Medit, 7(4): 54-60.

- Bölen F., Türkoğlu H.D., Yirmibeşoğlu F., 2009. Livable space, land-use intensity in Istanbul. Istanbul Technical University Journal, 8(1):127-137.

- Braimoh A.K., Onishi T., 2007. Spatial determinants of urban land use change in Lagos, Nigeria. Land Use Policy, 24: 502-515.

- Cakir P., Sesli F.A., 2013. Determination of factors affecting the real estate value of land property and the rank of importance of these factors. Electronic Journal of Map Technologies, 5(3): 1-16 (in Turkish).

- Cosar G., Engindeniz S., 2013. Hedonic analysis of agricultural land values: the case of Menemen, Izmir. Ege University Agriculture Faculty Journal, 50(3): 241-250 (in Turkish).

- Court A.T., 1939. Hedonic price indexes with automotive examples. The Dynamics of Automobile Demand, General Motors Corporation, New York, 99-117.

- Forster D.L., 2006. An overview of U.S. farm real estate markets. Working Paper: AEDE-WP-0042-06, Department of Agricultural, Environmental, and Development Economics, The Ohio State University, Paper originally presented at the General Assembly of the CICA (International Confederation of Agricultural Credit), Quebec, Canada, 29-30.

- Goodman A.C., 1998. Andrew court and the invention of hedonic price analysis. Journal of Urban Economics, 44: 291-298.

- Grimes A., Liang Y., 2007. Spatial determinants of land prices in Auckland: does the metropolitan urban limit have an effect. Motu Working Paper 07-09, Motu Economic and Public Policy Research.

- Guiling P., Doye D., Brorsen B.W., 2009. Agricultural, recreational and urban influences on agricultural land prices. Agricultural Finance Review, 69(2): 196-205.

- Guri F., Topulli E., Paloma S.G.Y., 2016. Does agriculture provide enough incomes for the rural households? The Albanian case. New Medit, 15(1): 17-27.

- Haas G.C., 1922. A statistical analysis of farm sales in Blue Earth County, Minnesota, as a basis for farm land appraisal. Master Thesis, The University of Minnesota.

- Karakayaci Z., 2011. Using geographic information systems in agricultural land valuation: the case of Konya Province Çumra. PhD Thesis, Selçuk University, Institute of Social Sciences, Konya, Turkey (in Turkish).

- Kostov P., 2009. A Spatial Quantile Regression Hedonic Model of Agricultural Land Prices. Spatial Economic Analysis, 4(1): 53-72.

- Lancaster K.J., 1966. A new approach to consumer theory. Journal of Political Economy, 74(2): 132-157.

- Naydenov I., 2009. Factors influencing farmland prices in Bulgaria, Master Thesis, Maastricht University.

- OMU, 2018. Ondokuz Mayis University Statistics. Retrieved 2018 February 4 from http://oidb.omu.edu.tr/istatistikler.

- Pa´ez A., Uchida T., Miyamoto K., 2001. Spatial Association and Heterogeneity Issues in Land Price Models. Urban Studies, 38(9): 1493-1508.

- Patton M., McErlean S., 2003. Spatial Effects within the Agricultural Land Market in Northern Ireland. Journal of Agricultural Economics, 54(1): 35-54.

- Rosen S., 1974. Hedonic prices and implicit markets: product differentiation in pure competition. The Journal of Political Economy, 82(1): 34-55.

- Samulas, 2018. Statistics. Retrieved 2018 February 4 from http://www.samulas.com.tr.

- Sklenicka, P., Molnarova, K., Pixova, K.C., Salek, M.E., 2013. Factors affecting farmland prices in the Czech Republic. Land Use Policy, 30:130-136.

- Stewart P.A., Libby L.W., 1998. Determinants of farmland value: The Case of DeKalb County, Illinois. Review of Agricultural Economics, 20(1): 80-95.

- TUIK, 2018. Turkish Statistical Institute. Retrieved 2018 February 10 from 15, http://www.tuik.gov.tr

- Wallace H.A., 1926. Comparative farm-land values in Iowa. The Journal of Land & Public Utility Economics, 2(4): 385-392.

- Waugh F.V., 1928. Quality factors influencing vegetable prices. Journal of Farm Economics, 10(2): 185-196.

- Wen H.Z., Jia S.H., Guo X.Y., 2005. Hedonic price analysis of urban housing: an empirical research on Hangzhou. China. Journal of Zhejiang University Science, 6A(8): 907-914.