Abstract

This article aims at analyzing Algerian farmers’ choices of marketing channels in the date-palm supply chain. Five main marketing channels were investigated: local market, intermediaries, conditioning structure, processors contracting and complete integration. Primary data collected from a sample of 118 date farmers through a field survey in Biskra region. Beside some basic statistical tools, a multinomial discrete choice model was used to analyze and evaluate the major factors affecting marketing channel choices. From the main results of this study, it was concluded that downstream vertical integration practices are lead by income-related risks minimization, and the upstream vertical integration is favorable for further downstream vertical integration. The research would provide valuable information about the date palm producer’s marketing decision-making process and thus would contribute to improving the efficiency and effectiveness of dates industry in Algeria.

DOI: 10.30682/nm1903d

Mohamed Amine Benmehaia*

* Department of Agricultural Sciences, University of Biskra, Algeria.

Corresponding author: ma.benmehaia@univ-biskra.dz

Cite this Item: Benmehaia M. A., Farmers’ Income Risks and Marketing Channel Choices: Case of Date Palm Processing in Biskra, Algeria, New Medit, 18 (3): pp. 47-58, http://dx.doi.org/10.30682/nm1903d

1. Introduction

The industrialization of the agricultural sector imposes more narrowing between the actors of the agrifood chains. One of the major challenges for a farmer is to sell his farm products. For this, he opts for strategies that allows him to ensure the continuity of his business. However, as a response to the industrialization of agriculture, contracting arrangements are increasingly coordinating modern agricultural supply chains, the exact form of this governance structure, however, can vary widely according to situation-specific variables (Kirsten and Sartorius, 2007).

In several developing countries in Africa, actors in liberalized agricultural markets operate in a context in which prices are not publicly announced, products are highly differentiated without a formal system of standardization, contracts are verbal and non-standardized, lack of control and certification, and less resort to the legal system for enforcing contracts (Fafchamps and Menten, 2001; Fafchamps, 2004; Gabre-Madhin, 2001). This is actually our case. The Algerian farmer opts for choices that provide him with stable income. The governance structures governing date production marketing transactions have evolved significantly over time given the structural changes that have been encountered.

In this study, as Mbaga (2012) so clearly states, «a marketing channel describes the movement of a product or commodity from the site of production to the place of consumption. […] There is no one universal set of marketing channels because each country is unique and institutions involved operate differently under different sets of infrastructure». The different modes of agricultural production marketing are essentially based on a contractual arrangement having some peculiarities. This can be defined as follows: Agricultural marketing contracts are mainly downstream sales contracts whereby the contractors purchase the production from the producers. The arrangement is usually verbal or in a form that is not acceptable for the settlement of disputes in a legal court (Jabbar et al., 2007).

In fact, marketing contracts have several advantages for both contracting parties. Essentially, according to Federgruen et al., (2015), they create the guarantees necessary to maintain the continuity of vulnerable farmers’ activities while they help processing companies to manage supplies. However, in this paper, we aim to study the determinants these forms of downstream vertical coordination in date-palm production marketing in Biskra region by revealing the empirical regularities in this behavior. We confirm, moreover, the hypothesis concerning the motivation of downstream vertical contracting and its relationship with the upstream vertical coordination.

The article begins with a brief introduction to date-palm sector in Algeria and presents the main hypotheses. The following section discusses the research methodology (the data collection strategy and the econometric approach). The next section presents the main empirical findings and discussions. The article ends with concluding remarks and policy implications.

2. Study Context and Research Hypotheses

The most common choice in farm production marketing is the direct use of the spot market. As changes occur in a producer’s institutional environment, several forms of downstream contractual forms have emerged through a rich palette of forms of vertical coordination. The small farmer is perplexed in the choice of investment between these different marketing channels. The dilemma is relevant and the choice is under constraints mainly related to specific investments. However, the dominance and persistence of small farms at the local level is an enigma that could be explained by the presence of diseconomies of scale in marketing (Fafchamps and Minten, 2001).

Specifically for our case, the region of Biskra has a very old vocation for the production of dates (in its different varieties). It is an important part of the Algerian date palm sector (Zitouni, 2010; Benziouche, 2013; Benziouche and Cheriet, 2012). It includes almost 21 500 date producers distributed over a total area of 146 000 ha with 3.45 million palm palms (according to recent statistics from the DSA in 2017). Therefore, date-palm producers in Biskra region encounter increasingly by sheer force more inconveniences to market their farm products, hence the necessity to highlight a preliminary analysis of marketing channels.

The most common marketing channels in this sector was the resort to the local market (direct marketing) or subsistence (self-consumption) considering the rural specificities of this region. Nevertheless, since the colonial era, several forms have emerged, including export channels, State oriented marketing boards, intermediation, etc. Currently, we can perceive a tendency towards more vertical integration. This diversity in the forms of vertical coordination mechanisms exhibits the adaptive capacity of producers towards better performances. Contractual relations with the farmers, and the certainty for the producers of dates to find an industrial outlet for their hard-to-sell dates production are guarantees strong enough to worry about the upstream of the industry (Zitouni, 2010). The study of these forms of integration (or coordination) is of interest for the performance of the sector as a whole. According to Zitouni (2010), the advantages of vertical integration in the dates production are mainly: 1) take advantage of production synergies and technological know-how, 2) savings on upstream and downstream costs, 3) organize an integrated logistics, 4) securing activities and 5) establishing a natural monopoly.

On the other hand, the contractual arrangements for marketing channels are also determined by several variables specific to the producers (Djermoun et al., 2014, and Benmehaia and Brabez, 2018, as examples for Algerian context). Several studies have shown that certain technological, economic and social factors influence the choice of marketing channels, i.e. downstream vertical coordination forms in fruit and vegetable value chains. Among studies worldwide we quote mainly, Shapiro and Brorsen (1988), Poole et al. (1998), Gong and Zhou (2007), Pennings et al. (2008), LeRoux et al. (2009), Katchova (2010), Mabuza et al. (2014), Arinloye et al. (2014). The main variables highlighted are mainly risk, farm size, farmer experience and education, off-farm work, and specialization. Each of these variables has a particular effect on the choice of marketing channels in the date production. However, other factors could also have different effects on this choice (Siddique, 2018).

For these reasons, in this paper we aim to study these forms of downstream vertical coordination in date production marketing in Biskra region by revealing the empirical regularities in this behavior. Four marketing channels have been thoroughly investigated namely: direct local market, intermediation, processing oriented contracting, and complete integration. We make two hypotheses: 1) Downstream vertical integration practices are lead by income-related risks minimization, and 2) Upstream vertical integration is favorable for further downstream vertical integration. In order to verify and analyze the subject in more detailed manner, we carry out an empirical study of the forms of downstream vertical coordination practices by a survey carried out in the region.

3. Research Methodology

This study has as a unit of analysis the producer of dates (all varieties combined) in the Wilaya of Biskra (Algeria) including 33 communes. Data were collected in 2017 with survey questionnaire. Date producers were selected from this area using a randomly stratified sampling procedure on 21 502 dates farmers population, based on a size criterion. We obtained a database of 11 547 of intermediate-sized producers. A sample of 118 date producers were chosen.

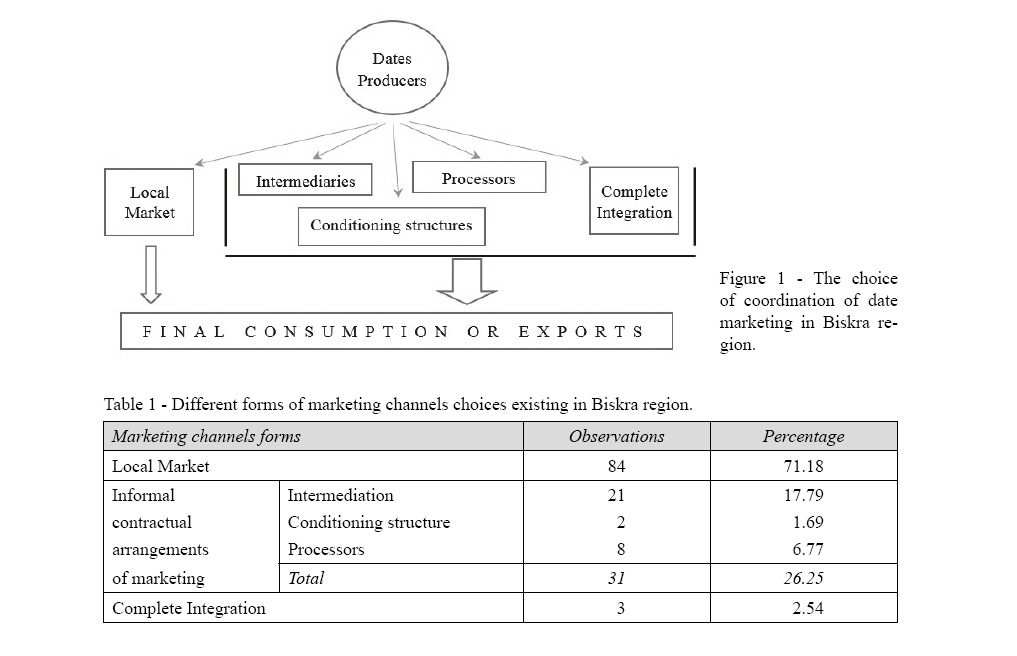

The phenomenon variable observed in this study incorporates the different forms of marketing channels of date production in the Biskra region. We observed from our primary investigation that at first glance two main forms of production marketing: (1) direct resort for the local market, (2) the use of informal delivery arrangements. The second alternative includes some discrete choices that reflect certain forms of vertical coordination. It encompasses the use of an intermediary (wholesalers or owners of conditioning infrastructure); the use of an informal arrangement with a local processing company (canneries); or the ownership of vertical control structure from processing, packaging and sales channels for final consumers (as shown in Figure 1).

We will first consider the dichotomous choice between the use of (informal) contractual relations and the use of the local market. Second, we detail a little more the existing vertical coordination forms (intermediation, processors contracting, complete integration). Table 1 shows the proportions of different forms of vertical coordination existing in the Biskra region.

This table displays a maximum value for producers using the local market with a percentage of 71%, while full integration is less present with a very low percentage (2.5%). The other intermediate forms of vertical coordination are present with a considerable percentage (about 26%) where the intermediation has the highest share (17.7%).

We use for the analysis 10 explanatory (quantitative and qualitative) variables that the database resulting from our field survey offered us. The first block of variables groups together the technical and economic variables of a date production farm, including the size of the farm (in hectares), the technical density of palms (palms per hectare), the use of agricultural machinery, the possession of water drill, farm specialization in dates production and off-farm activities (last four are captured by binary variables). The most basic variable is farm income (in terms of estimated revenue). It is captured by a direct question where the answers were always by approximations. For this reason, we encoded it with a multinomial variable including four classes. The first class reflects less 500 ULC, the second class groups income between 500 and 2 000 ULC, the third class between 2 000 and 5 000 ULC and the last class includes farms with income above 5 000 ULC.

The second block of variables reflects the socio-economic aspect of the farm. We used the farmer’s age, his experience, his education level, and the size of his household.

The use of a marketing arrangement for a farmer could be formulated by an expression linking the farmer’s transaction of date production marketing V with certain observable characteristics of his farm noted X = {Xi} in the form:

Vi = 𝛽 X + ξ𝑖

where β is the coefficients vector, ξ𝑖 represents the underlying error term. We estimate Vi by a binary variable (symbolized by V1 and V2). As a result, we first use two logistic regressions with the maximum likelihood estimate (i.e., the Logit model) in order to reveal the determinants of the use of an informal arrangement of marketing channel (V1) and the direct resort for the local market (V2). The form that the model takes is as follows:

P(V1= 1 |X) = Γ(𝛽X) = e𝛽1X / (1 + e𝛽1X)

P(V2= 1 |X) = Γ(𝛽X) = e𝛽2X / (1 + e𝛽2X)

where X represents the vector of explanatory exogenous variables, β1 and β2 of the estimated coefficient vectors, Γ(.) represents a logistic cumulative distribution function. Logit is defined as the natural logarithm of odds values in favor of positive responses (Hosmer and Lemeshow, 2000; Greene, 2003; Hensher et al., 2005; Cameron and Trivedi, 2005).

Second, we use a multinomial ordered Logit regression with the maximum likelihood estimation (Katchova and Miranda, 2004; Katchova, 2010) to reveal the determinants for all discrete choices of underlying marketing channel choices (V3). The dependent variable V3 incorporates four values of the coordination forms encountered: 0 for the local market, 1 for intermediation, 2 for the processor contracting, 3 for complete integration. The form that the multinomial Logit model takes is:

P(V3|X) = e𝛽3X / (1 + e𝛽3X)

where X represents the vector of explanatory exogenous variables, β3 a vector of estimated coefficients, with a logistic cumulative distribution function (Amemiya, 1981; McFadden, 1980; Greene, 2003; Hensher et al., 2005).

4. Results and Discussions

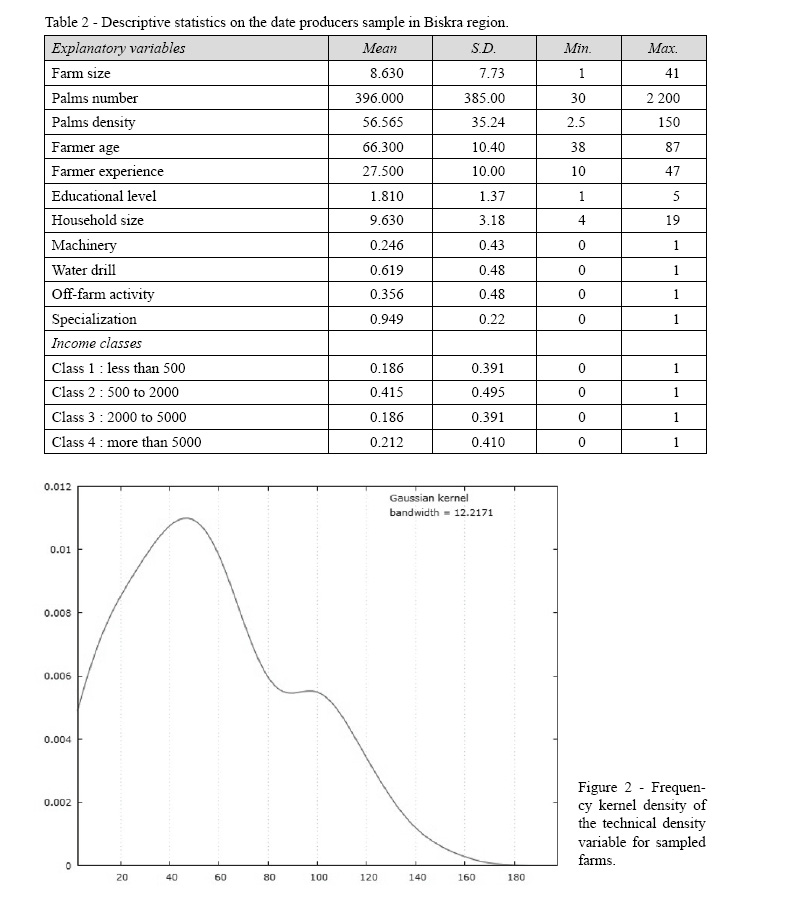

Table 2 displays the main characteristics of the date producers sample (118 observations) through the main descriptive statistics (mean, standard deviation, minimum and maximum values). Regarding the farm size, it has an average of 8.6 hectares (with a standard deviation of 7.7) where the minimum value is 1 ha and the maximum is 41 ha. The number of palms per farm averages 396 palms (with a maximum value of 2 200 palms). This does not reflect the reality. To apprehend this dimension, we use the technical density expressed by the number of palms per hectare. It shows an average of 56 palms per hectare.

Figure 2 shows the density of frequencies of the technical palms density for sampled farms. It displays the different modalities in terms of the technical density of date production farms.

It is clear that the structure is bimodal with both values of 50 and 100 palms per hectare as two modes used in date production in Biskra region. This reveals the duality nature of date palm technology manifested in this sector.

On the other hand, the average age of a date producer is 66 years, his average experience is 27 years, his household has an average of 9 individuals and his average level of education is the primary school. In addition, according to these descriptive statistics, it turns out that 25% of producers own farm machinery, 62% have their own water drill, 36% have non-farm work, and 95% are specialized in date production. Regarding the income variable, it seems that the modal class is second (that between 2 000 and 5 000 ULC) being a dominant middle class (with 41.5%). Classes 1 and 3 are present with a percentage of 18.6%, class 4 with 21.2%.

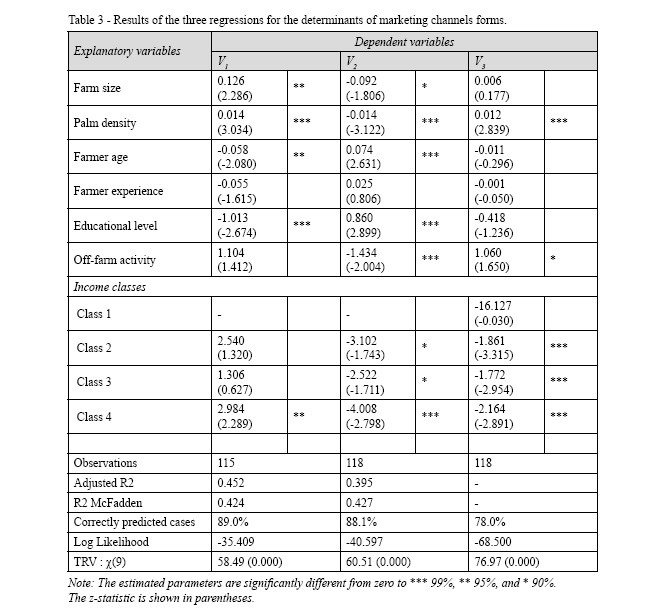

The results of three regressions examining the determinants of marketing channels forms are shown in Table 3. Multi-collinearity is examined by Inflation Factor and contingency coefficients. The calculated IF is less than 10 (rejection threshold) and the contingency coefficients are less than the 0.75 (rejection threshold) for the explanatory variables in these models. This indicates that multi-collinearity poses no problem in modeling. The three models of Logit have a correctly predicted percentage of cases of 89.0%, 88.1% and 78.0% respectively, which means that the models have good predictive values. The adjusted correlation coefficient and that of McFadden are highly significant. The likelihood ratios chi-squares are 58.49, 60.51 and 76.97 with p values of less than 0.001 means that each of the three models is statistically significant, i.e., it fits significantly better than a model with no predictors.

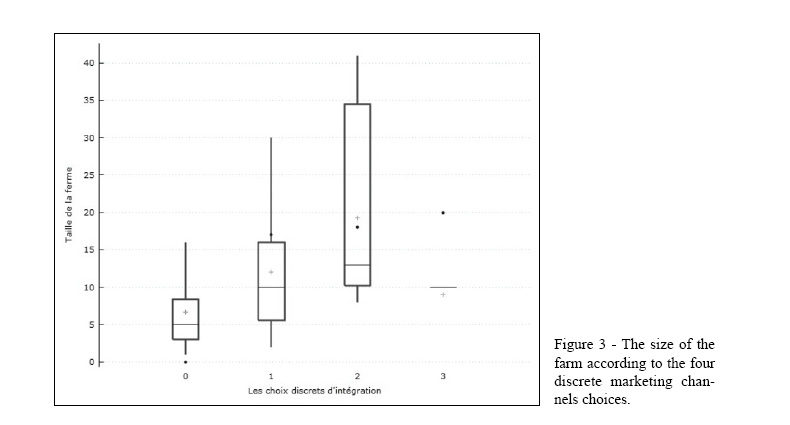

Regarding the two variables that correspond to the technical-economic aspect, we note that the farm size and the technical density have a positive marginal effect on the use of contractual arrangements in both models V1 and V3 (with high statistical significance at 1%).

In order to show with greater clarity the effect of these two technical-economic variables on the farmers’ marketing channels choices, we proceed two plotbox diagrams according to the four discrete forms.

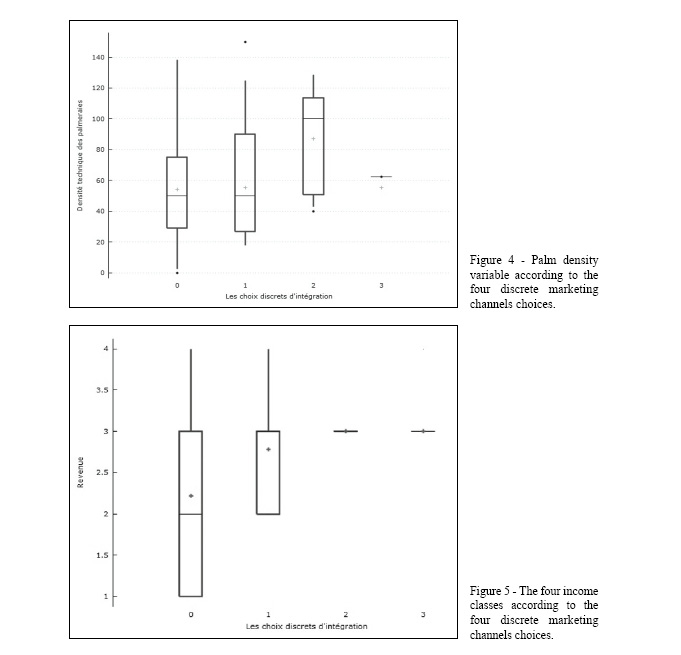

Figures 3 and 4 display the positive effect of size and density. In terms of size, small farms tend to use the first two discrete choices (local market and intermediation), whereas the use of a contract with a local processor is reserved for medium and large farm size. The complete integration seems to be reserved for the size of about 10 ha (and having more than 500 palms). From density side, the users of the local market seem to group the whole range of densities, while it is reduced progressively along the other choices by arriving at the choice of the complete integration with a density of almost 62 palms per hectare.

On the other hand, the income class variable exerts an influence (statistically significant) in all three cases. For the use of contractual arrangements in both models V1 and V3, it shows a positive marginal effect, i.e., the use of different contractual arrangements (in our case, informal) generates more revenue. To show this effect in more detail, we proceed to a plotbox diagram showing the four classes of income according to the four discrete marketing channels choices.

Figure 5 examines empirically not only the positive effect of graduated forms of farm integration on its income; but also highlights the consideration of income-related risks. This confirms the hypothesis advanced by this study that the motivation of more downstream vertical integration is the minimization of income-related risks. The first form (having the value 0), reflecting the local market, presents a large variance compared to other classes of income. Whereas progressively we proceed towards more downstream vertical integration, this variance vanishes until the fourth form.

As for the two socio-economic variables, age and educational attainment show statistically significant negative effects on the use of contractual arrangements (V1 and V3). This indicates that older or more educated farmers tend to be market-choice users (confirmed by the statistically significant positive effect of their coefficients in the V2 model). The farmer’s experience confirms the same observation while it seems to be statistically insignificant. The off-farm activity has a statistically significant negative effect on the choice of market use. This suggests that farmers with off-farm work tend to use contractual arrangements (V1 and V3).

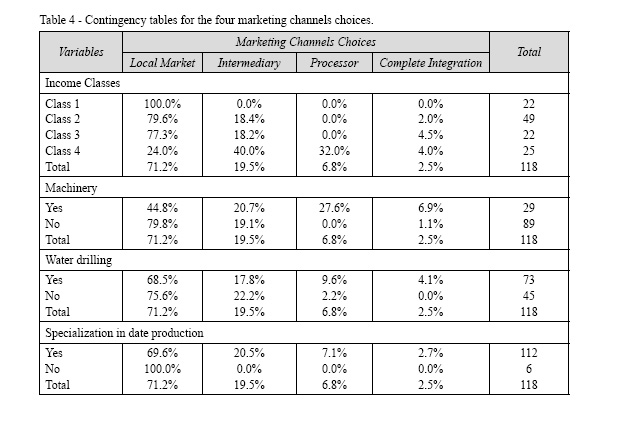

Secondly, and apart from econometric modeling, our database from our survey in the region allowed us to proceed with contingency tables (cross-tabulations) due to its richness in qualitative variables. The set of contingency tables for the four marketing channels choices is shown in Table 4. The variables that they were crossed with V3 are respectively: income classes, possession of agricultural machinery, possession of farm-specific drill and specialization in date production.

Regarding the first crossed variable, the income, it seems that the first class (usually farms in a vulnerable situation) entirely opts for the choice of using local market (100%). The more the farm gets richer, the more are likely to opt for other forms of integration. Another observation could be raised. Class 4 appears to be dominant in intermediate forms of vertical integration (i.e., intermediation and processor contracting) with 71.2%.

The following two crossed variables, machinery and water drilling, appear to have the same consequence. Being specific assets and they both reflect an aspect of upstream vertical integration, they seem less present in the case of market, almost the same proportions in intermediation, more abundant beyond the processor contracting. This indicates that any specific investment in upstream vertical integration capabilities is favorable for further vertical downstream integration.

The specialization variable in date production shows that any diversified farm chooses to use the local market. Those who specialize in the production of dates are gradually distributed over the various choices, knowing that they represent a high percentage (95%). This remains statistically insignificant. The three latter crossed variables confirm the second hypothesis of this study.

5. Conclusion

This study dealt with the contractual relations in the production of dates (region of Biskra, Algeria), where we were able to present and analyze the different existing marketing channels forms. We have revealed within an empirical basis the differences in terms of the choice of coordination of date production marketing between farmer and the various downstream links. We have been able to identify some interesting results having major implications for better performance in the value chain of date production.

To conclude, we can draw some lessons upon the main results. This study confirms the fact that downstream vertical integration practices towards more extreme forms are motivated by the concern of minimizing risks related stabilizing farmers’ income. This has a major theoretical and factual implication that risk and uncertainty shape the institutions that govern a farmer’s transactions. Further studies on this direction will be very useful for public policy of stabilization and subsidy.

Another main result stipulates the dominance of downstream intermediaries, which from an economic point of view affects negatively the performance in the value chain (mainly the prices). The prevalence of intermediaries traders and the various intermediation institutions only weaken the situation of small producers and lengthen the chain without a real performance in terms of net benefit. This involves the intervention of the public authorities in order to remedy these shortcomings and contribute to improving the well-being of small producers. Public authorities could provide some incentive schemes to encourage producers to contract and sell their products directly to processing companies or certified structures in order to facilitate the establishment of traceability and promote the development of a value chain with better performance.

The determinants of closer downstream vertical integration appears to be strongly related to the key structural and economic features of a date farm such as its upstream integration aspects (input factors) and production technology specific to dates (crop density, specialization) and size (reflecting economies of scale) and the structure of income (risks and non-agricultural activity). All of these effects should be taken into account by public policy to promote the development of a local date chain and encourage small producers toward better performances. The main recommendations from this study emphasize on the progress toward more narrower structure for date-palm producers, based on the fact that risks play an important role given the absence of direct state intervention in its vertically linked systems. One possible way is an intervention by strengthening of collective action of date-palm producers by the formation of effective producer organizations in order to regulate more efficiently date-palm chain value and facilitate vertical coordination in the food system. Finally, all these components can be taken into account in the implementation of an agricultural policy aiming to benefit from a growing vertical coordination of this sector.

Nevertheless, this study presents some shortcomings in terms of quantity and quality. Quantitatively, our sample remains insufficient for such ambitions. Subsequent studies incorporating more observations and more explanatory variables (mainly prices) will be of great benefit. Qualitatively, the four marketing channels forms in vertical coordination envisaged here deserve more attention one by one and with regard to eventual interlinkages. Further in-depth studies will be a real step forward in understanding the farmer’s behavior and performance. Each of these forms should be studied separately where the comparison will be even more relevant.

References

- Allen D., Lueck D., 2004. Agricultural Contracts. In: Ménard M., Shirley M. (eds.), Handbook of New Institutional Economics. Dordrecht: Springer, pp. 465-490.

- Amemiya T., 1981. Quantitative Response Models: A Survey. Journal of Economic Literature, 19: 1483-1536.

- Arinloye D.A., Pascucci A.S., Linnemann A.R., Coulibaly O.N., Hagelaar G., Omta W.F., 2014. Marketing Channel Selection by Smallholder Farmers. Journal of Food Products Marketing, 21(4): 1-21.

- Benmehaia M.A., Brabez F., 2018. Vertical Relationships and Food Supply Chain Coordination: The Case of Processing Tomato Sector in Algeria. New Medit, 2: 3-14.

- Benziouche S.E., 2013. The Sector of Dates in Algeria: Role in National Economy and Position on the International Market. Acta Horticulturae, 994: 155-162.

- Benziouche S.E., Cheriet F., 2012. Structure et contraintes de la filière dattes en Algérie. New Medit, 11(4): 49-57.

- Cameron A.C., Trivedi P.K., 2005. Microeconometrics: Methods and Applications. Cambridge: Cambridge University Press.

- Djermoun A., Belhadia M., Chehat F., Bencharif A., 2014. Les formes de coordination entre les acteurs de la filière lait au niveau de la région de Chéliff. New Medit, 13(3): 39-49.

- Fafchamps M., 2004. Market Institutions in Sub-Saharan Africa: Theory and Evidence. Cambridge (MA): The MIT Press.

- Fafchamps M., Minten B., 2001. Property Rights in a Flea Market Economy. Economic Development and Cultural Change, 49(2): 229-267.

- Federgruen A., Lall U., Simsek A.S., 2015. Supply Chain Analysis of Contract Farming. Working Paper.

- Fernández-Olmos M., Vinuesa L.M.M., 2009. Spot Market versus Incentive Contract. New Medit, 8(3): 12-20.

- Gabre-Madhin E.Z., 2001. Market Institutions, Transaction Costs and Social Capital in the Ethiopian Grain Market, Research Report 124, International Food Policy Research Institute, Washington D.C.

- Gong W., Zhou Z., 2007. Transaction Costs and Cattle Farmers’ Choice of Marketing Channels in China: A Tobit Analysis. Management Research News, 30(1): 47-56.

- Greene W.H., 2003. Econometric Analysis, 5th ed. Upper Saddle River: Prentice Hall.

- Hensher D.A., Rose J.M., Greene W.H., 2005. Applied Choice Analysis: A Primer. Cambridge: Cambridge University Press.

- Hosmer D.W., Lemeshow S., 2000. Applied Logistic Regression, 2nd ed. New York: John Wiley.

- Jabbar M.A., Rahman M.H., Talukder R.K., Raha S.K., 2007. Formal and informal Contract Farming in Poultry in Bangladesh, FAO Conference Poultry in the 21st Century, Avian Influenza and Beyond, Bangkok.

- Joskow P.L., 1995. The New Institutional Economics: Alternative Approaches. Journal of Institutional and Theoretical Economics, 151(1): 248-259.

- Joskow P.L., 2005. Vertical Integration. In: Ménard C., Shirley M. (eds.), Handbook of New Institutional Economics. Dordrecht: Springer, pp. 319-348.

- Katchova A.L., 2010. Agricultural Contracts and Alternative Marketing Options: A Matching Analysis. Journal of Agricultural and Applied Economics, 42: 261-276.

- Katchova A.L., Miranda M.J., 2004. Two-Step Econometric Estimation of Farm Characteristics Affecting Marketing Contract Decisions. American Journal of Agricultural Economics, 86(1): 88-102.

- Kirsten J., Sartorius K., 2007. A Framework to Facilitate Institutional Arrangements for Smallholder Supply in Developing Countries: An Agribusiness Perspective. Food Policy, 32(5-6): 640-655.

- Klein P.G., 2004. The Make-or-Buy Decision: Lessons from Empirical Studies. In: Ménard C., Shirley M. (eds.), Handbook of New Institutional Economics. Dordrecht: Springer, pp. 435-464.

- LeRoux M.N., Schmit T.M., Roth M., Streeter D.H., 2009. Evaluating Marketing Channel Options for Small-Scale Fruit and Vegetable Producers, Working Paper, Department of Applied Economics and Management, Cornell University, Ithaca, New York, 14853-7801.

- Mabuza M.L., Ortmann G., Wale E., 2014. Effects of Transaction Costs on Mushroom Producers’ Choice of Marketing Channels: Implications for Access to Agricultural Markets in Swaziland. South African Journal of Economic and Management Sciences, 17(2): 207-219.

- Mbaga M.D., 2012. Date Marketing. Chapter 11. In: Manickavasagan A., Mohamed Essa M., Sukumar E. (eds), Dates: Production, Processing, Food, and Medicinal Values. Boca Raton (FL): CRC Press.

- McFadden D., 1980. Econometric Models for Probabilistic Choice among Products. The Journal of Business, 53(3) Part 2: Interfaces Between Marketing and Economics: S13-S29.

- Ménard C., Valceschini E., 2005. New Institutions for Governing the Agri-Food Industry. European Review of Agricultural Economics, 32(3): 421-440.

- Pennings J.M.E., Isengildina-Massa O., Irwin S.H., Garci Ph., Good D.L., 2008. Producers’ Complex Risk Management Choices. Agribusiness, 24(1): 31-54.

- Poole N.D., Gomis F.J., Igual J., Gimenez F.V., 1998. Formal Contracts in Fresh Produce Markets. Food Policy, 23(2): 131-142.

- Shapiro B.I., Brorsen B.W., 1988. Factors Influencing Producers’ Decisions of Whether or Not to Hedged. North Carolina Journal of Agricultural Economics, 10: 145-153.

- Siddique M.I., Garnevska E., Marr N.E., 2018. Factors Affecting Marketing Channel Choice Decisions of Smallholder Citrus Growers. Journal of Agribusiness in Developing and Emerging Economies, 8(3): 426-453.

- Williamson O.E., 1975. Markets and Hierarchies: Analysis and Antitrust Implications. New York: The Free Press.

- Williamson O.E., 2000. The New Institutional Economics: Taking Stock, Looking Ahead. Journal of Economic Literature, 38(3): 595-613.

- Zitouni B., 2010. La nouvelle économie phoenicicole. Alger: Collection Tagdempt.