Abstract

This paper analyzes the vertical relationship between growers and processors in the Algerian tomato processing industry. We use extensive data on production contract outcomes for processing tomato growers (including 3,740 coordinated contracts) to examine the performance of grower-processor vertical contracts. The results indicate that the tomato grower-processor vertical relationship undergoes some deficiencies resulted in social welfare losses and lower level in contractual performance. From the side of processors, the industry has an oligopsonic structure (with CR4: 57%). From the side of tomato growers, the results indicate a relatively higher contractual default (with 53% in average). These findings suggest that public policy should pay more attention for the performances levels of the used vertical coordination mechanism in order to provide more incentive instruments and by leveraging vertical contract for tomato growers’ benefit.

DOI: 10.30682/nm1802a

Mohamed Amine Benmehaia*, Fatima Brabez*

* Département d’Economie Rurale, Ecole Nationale Supérieure Agronomique, Avenue Hassan Badi, El Harrach, Algérie.

Corresponding author: m.benmehaia@st.ensa.dz.

1. Introduction

A first exercise of production contract for processing tomatoes in Algeria was initiated last year, where the Ministry of Agriculture approved changes in the tomato supply chain by regulating the vertical relationships between tomato growers and processors by the remuneration of growers through a premium price (1 DA for a produced and delivered kg of industrial tomato). Particularly, the vertical relationship was governed by a formal private contract between a number of processors and individual growers with an intermediation of the Ministry. Tomato quantity was a key concern for processors, and is reflected contractually in explicit yield-related performance incentives. We have obtained an extensive data on the contractual terms of all loads of processing tomatoes produced in Algeria over its first exercise, and observe the contractual terms involving growers’ farm size, production and yields for each of these loads. In this paper, we attempt to analyze the performance of this contractual arrangement.

The data used in our study include all loads of tomatoes (3,759 growers) delivered to 20 processors over 2016 exercise in which single type of contract is employed. The structure of the contracts we observe is relatively simple (i.e., unidimensional and linear) in comparison with more complex contracts observed in other settings. The unidimensionality is related to the merely production quantity term and the linearity is about the linear relation of price premium to the delivered quantity. The price in contracts is quite exogenous and it is based on an expected market price. Therefore, this study attempts to answer the following questions: does the used contract generate any performances? And what recommendations would be derived for the public policy?

Briefly, the results indicate that vertical contractual relationships in the Algerian tomato industry suffer some deficiencies. First, despite the increased number of tomato processors, the industry still manifests an oligopsonic structure. Second, the empirical evidence suggests that there is a higher level of contractual default as a consequence for some insufficiencies in contract structure. Finally, we model the contract choice (over spot market) where the results suggest that the farm scale and yield are significant determinants of vertical contracting.

The paper is structured as follows. In the following section, we present some basic concepts for vertical coordination in agrifood supply chain. Section 3 describes the research methodology. Section 4 presents an overview of contracting in processing tomato industry in Algeria through preliminary analysis. Section 5 explores the main empirical results. Section 6 discusses the results and drives some policy recommendations. Final section concludes.

2. Vertical Coordination in Agri-Food Supply Chain: Basic Concepts

To the extent that we can conceive the food system as a series of vertically interrelated stages (with reference to filière approach) from natural resources to final consumption, the vertical coordination refers to the means by which products move through the supply chain from producers to consumers (Mighell and Jones, 1963; Katz, 1989; Perry, 1989; Young and Hobbs, 2002; Monteiro et al., 2012). Therefore, vertical relationships are basically defined as the business arrangements between upstream and downstream actors, and they rely on price signals as well as ex-ante non-price agreements. They are subject to a diversity of governance mechanisms.

The well-known and well-documented governance mechanisms for coordinating economic activities involved in vertical relationships are: (1) Vertical integration, (2) Contracts and (3) Markets. Vertical integration implies coordination through a complete acquisition of ownership and control of production and distribution stages, while the two other mechanisms involve coordination between independent firms. The choice of one mode of allocation over another was explained by vague references to transactions costs, internal efficiencies, risk aversion and economies of scale (Joskow, 1985; 2008). Conceptually, farmer-processor relationships encompass a continuum with a spot market at one extreme, and farmer-processor vertical integration form at the other extreme (Sexton and Lavoie, 2001). In between covers a large diversity of contractual forms (considered as hybrid forms in transactions costs approach). Nevertheless, the performance of both quantity and quality in food supply chains will be dependent on how the product produced by suppliers is coordinated. Consequently, the nature of quantity and quality flows often implies that decentralized coordination may result in a failure in supply chain performance and technically inefficient production by suppliers.

From the big picture of food systems, we observe a trend towards closer vertical coordination. This has occurred as the use of spot markets has declined, while production and marketing contracts, franchising, and full vertical integration have increased. Besides, contracting and other forms of vertical coordination are important parts of the supply chains for many agricultural products (Goodhue et al., 2010; Abebe et al., 2013). As forward contracting has become more important for the agri-food industry of developing countries, there is a demand for better insight about the forward contracting for farmers and processors, as well as in the conditions under which forward contracting works both efficient and fair (Bijman, 2008).

The major reasons for the increased use of contractual arrangements in food system are: First, contractual arrangements help both growers and processors to better manage risk (MacDonald et al., 2004; Wolf et al., 2001). Second, contractual arrangements can help growers and buyers in their resource allocation decisions due to the predictability introduced into production (Hueth et al., 1999). Furthermore, vertical contracting may reduce the transaction costs compared to a spot market arrangement (Mishra and Perry, 1999; Perry, 1989; Bijman, 2008).

The empirical evidence on the food supply chain coordination suggests that price stabilization mechanisms or public contract farming are efficient ways to stabilize prices (Gérard et al., 2011). However, contracts require the existence of institutions to guarantee their performance. Hence, public action, legal or regulatory constraints may affect the structure of contracts (Hueth et al., 1999) toward more efficient form of contractual relationships.

With special reference to fruits and vegetables sector, growers face production and price risks associated with farming, and an increased uncertainty due to the characteristics of their products (Cook, 2011; Hueth and Ligon, 1999; Ligon, 2001, Vassalos et al., 2015), principally they are perishable and subject to severe price fluctuations. A possible option to mitigate these risks is the adoption of forward contracts. As parties integrate at least partially, through the use of contracts, to attain efficiency, they must align expectations and mitigate the associated risks.

Specially for processing tomato industries, perhaps that the well-documented case for vertical contracting is California (for example, Hueth et al., 1999; Hueth and Ligon, 2002; Goodhue et al., 2010), but we can observe an increasing interest for other countries such as for India (Dileep et al., 2002; Rangi and Sidhu, 2000), for Turkey (Tatlidil & Akturk, 2004; Gunes, 2006; 2007), in China (Zhu and Wang, 2007; Guo and Jolly, 2008), and for Portuguese (Oliveira, 2008). Therefore, this paper attempt to analyze, for the first time and in its first production exercise, the vertical contracting in Algerian processing tomato industry.

3. Research Methodology

In this study, we use an extensive data on production contracts outcomes for processing tomato growers administered and collected by the National Inter-Professional Office for Vegetables and Meat (ONILEV), Ministry of Agriculture. It includes a total of 3,758 private contractual arrangements for tomato provision. The study of the contracts allowed as the identification of the area contracted (in hectares), the quantity contracted and the effectively delivered (in tons).

We should describe first the contractual process as shown in Figure 1 in order to identify more correctly the farmer’s choice. The production contract proceeds as follows: In t0, tomato processors (m = 20 canneries) offer a contract, denoted C. The contractual parameters are the expected price (P0), the contracted quantity (Q0), and a premium price (r) where r = f(Q). This premium is an exogenous term which is imposed by the Ministry of Agriculture. The proposed arrangements are take-it-or-leave-it contracts, i.e., in t1 tomato growers could accept or reject the contract. If growers (3,740 farmers in our case) accept the contract, they will be engaged in the next farming season to produce and deliver their production to the contracted cannery. In t2, the time of production delivery, the grower has the choice to honor their contract or to shirk and sold his production in the local market (spot market). The growers whose honored the contract (2,956 farmers in our case) frequently modify, to a considerable extent, the contract at its real state in terms of the produced quantity (Q1). The contract become consequently of the form C’(P0, Q1, r). The growers whose resort to the spot market envisage an arrangement denoted by M(Pm, Q1), where Pm denote the market price.

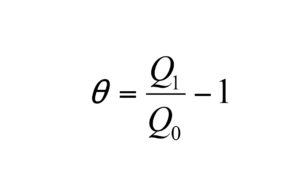

Figure 1 – The Tomato Growers-Processors Contracting Process.The analysis of vertical relationship will be conducted at two levels. The first level of analysis emphasizes on the contractual performance of grower-processor contract. We design an index in order to quantify the growers’ contractual performance. The indicator (denoted θ) would reflect the differential in the initial contracted quantity and the final delivered quantity. Its values should theoretically tend to zero. Nevertheless, the evidence from data shows that it has significant magnitude. Our index is expressed as follows:

This index reflects the differential between two measures (Q0 and Q1). Its values are superior to – 1. The values between – 1 and 0 reflect approximately the contractual default ratio.

At the second level of the analysis, we focus on the choice between the two governance structures for the final outputs of the process (Market vs. Contract). We shed the light on the determinants of the contractual choices of the growers for the final outcomes of the process, i.e., between C’(P0, Q1, r) and M(Pm, Q1). Consequently, we use the binary Logit model specification in order to determine the factors influencing growers’ contractual performance. Contract performance was defined when the production effectively delivered to the processor. The Logit model can be written as follows:

where X is a vector of explanatory variables (namely, farm size and yield), α is a vector of coefficient parameter and Γ(.) represents the logistic cumulative distribution function. The variable Y takes the value of 1 if grower chooses C’, and takes the value of 0 if he chooses M’.

4. Contracts in Processing Tomato Industry in Algeria

This section endeavors to portray, via a preliminary analysis, the contracting practice in processing tomato industry in Algeria. The industry of processing tomato is one of the most important filière in the Algerian food industries to the extent of its omnipresence the Algerian gastronomy. Recently, the economic organization of processing tomato segment showed some deficiencies (Bouzid and Bedrani, 2013), mainly the market power in canning industry, investment incentives, quality control and weakness of enforcement mechanisms. Therefore, it seems that vertical integration issues do actually matter for the industry performances (Bouzid and Bedrani, 2013; Bouzid and Padilla, 2014). That is why the analysis of vertical relationships in processing tomato sector should be more acutely investigated.

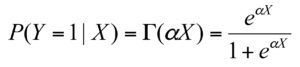

The empirical literature in market analysis admits that the key element in analyzing an agricultural commodity is its price fluctuation. In order to illustrate the price dynamics of tomato commodity in Algeria, we have plotted its monthly producer price (from January 2011 to December 2015) in Figure 2. The red line expresses the empirical values (DA/ton) where the blue one expresses the smoothed price.

Figure 2 – Monthly Producer Price of Tomato Commodity in Algeria.

The plot shows obviously a seasonal character. It shows lower prices in summer (from May until September) and higher prices for the rest of the year. Although, we can observe that the price variation in this season is significant. Nevertheless, in agricultural sector, the fluctuation in prices harms farmers because they make the profitability of investments extremely variable limiting incentives to intensify production (Gérard et al., 2011; Boussard, 2007). The evidence suggests here that particularly for processing tomato, the price shows obviously a virtual predictable movement. This could represent an advantage for the public action in enhancing vertical coordination in food supply chain.

From the extensive data we obtained, we can illustrate the whole sector in Algeria. Since 2010, it has been possible to perceive considerable improvements in yields (from 336 to 450-500 kg/ha). This can be observed in terms of production and area records, where the contracted tomato production has a value about 613 893 tons in 2016, while the cultivated acreage (in contracts) is 18,680 ha (an observed decrease from 2010 with 21,358 ha).

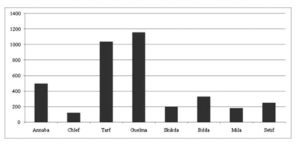

From the side of processors, they are distributed in nine regions (Wilaya) in Algeria (including Annaba, Blida, Chlef, Taref, Guelma, Skikda, Mila and Setif). The number of firms (processors, or more specifically canneries) has increased to 20 firms compared to last decade (5 firms). The share of the four leading firms (built the total tomato production delivered to firms) has a value of 57%, which indicates a strong concentration. The four largest firms in the Algerian tomato industry are respectively: the CAB (Cannery of Amor Benamor) in Annaba with a share of 33.16%, the cannery of Nouvelle Ere in Setif with a share of 8.58%, the cannery of Amour in Blida with a share of 7,84%, and the cannery of Latina in Mila with a share of 7,42%.

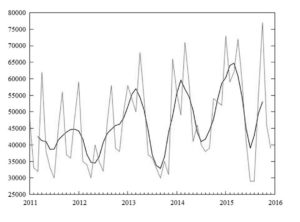

Figure 3 – Contracted Tomato Production by Regions.

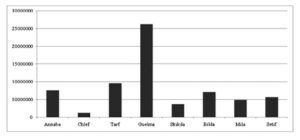

Figure 3 displays the histogram for contracted tomato production by regions. The data shows that Guelma has the most important production volume with 26,190 tons. From the side of contracted farmers, they are related to processors for each region. Figure 4 displays the histogram for the number of contracted tomato growers by regions. It seems from the plot that Guelma (with 1,157 contractors), Taref (with 1,035 contractors) and Annaba (with 497 contractors) have the most important number of tomato production contracts

Figure 4 – Tomato Growers Contrasts by Regions.

5. Empirical Results

The Table 1 presents some tomato growers’ characteristics for production contract. The table displays the grower-contractor number (N), the mean of farm size (MFS), the mean of contracted quantity (MQ0), the mean of delivered quantity (MQ1), contract commitment percentage (CP) and the value of the computed θ index. These parameters are examined in terms of regions and farm size.

Table 1 – Tomato Growers’ Contract Characteristics in Terms of Regions and Farm Size in Algeria.

|

N |

MFS |

MQ0 |

MQ1 |

CP |

θ |

|

|

Total |

3,740 |

4.99 |

3,420 |

1,640 |

79.03 |

– 0.53 |

|

By Regional Location of Growers |

||||||

|

Skikda |

1,752 |

4.81 |

320 |

138 |

76.43 |

– 0.57 |

|

Guelma |

667 |

5.38 |

382 |

263 |

93.10 |

– 0.30 |

|

Taref |

597 |

4.85 |

332 |

153 |

81.74 |

– 0.57 |

|

Annaba |

504 |

5.01 |

321 |

127 |

63.10 |

– 0.61 |

|

Chlef |

128 |

5.21 |

435 |

164 |

91.41 |

– 0.58 |

|

Ain Defla |

50 |

6.55 |

594 |

274 |

68.00 |

– 0.60 |

|

Tipaza |

29 |

4.75 |

369 |

270 |

100.00 |

– 0.27 |

|

Souk Ahras |

6 |

6.75 |

392 |

122 |

66.67 |

– 0.69 |

|

Oum Bouaghi |

5 |

6.20 |

372 |

277 |

80.00 |

– 0.15 |

|

Relizane |

2 |

6.00 |

60 |

59 |

100.00 |

– 0.88 |

|

By Farm Size |

||||||

|

Size 0-5 ha |

2,003 |

3.14 |

214 |

101 |

80.48 |

– 0.52 |

|

Size 5-10 ha |

1,453 |

5.88 |

396 |

167 |

75.77 |

– 0.54 |

|

Size >10 ha |

284 |

13.52 |

969 |

509 |

85.56 |

– 0.80 |

As can be seen in the table, a considerable number of growers are present in region having processors (such Skikda, Guelma, Taref and Annaba). These regions are located in the extreme North-East of the country, with a total of 3,652 growers.

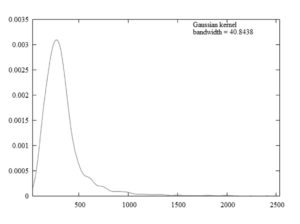

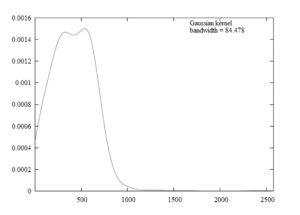

Figure 5 – Estimated Frequency Distribution for Contracted Tomato Quantity.

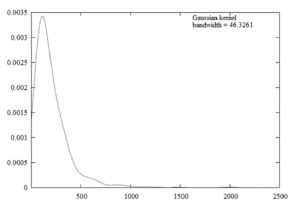

Figure 6 – Estimated Frequency Distribution for Delivered Tomato Quantity.

Tomato farm size is classified in three categories: small (less than 5 ha), medium (from 5 to 10 ha) and large farms (more than 10 ha). Small farms represent 2,006 growers, medium farms with 1,454 growers and large farms present with 284 growers. The average farm size for the whole sector is about 5 ha. In more detailed terms, the MFS for small, medium and large were approximately 3.14 ha, 5.88 ha and 13.52 ha respectively. In terms of regional locations of tomato growers, the MFS is between 4.75-6.75 ha, where it should be noted that higher values in MFS are located in regions without processors (Ain Defla, Tipaza, Souk Ahras, Oum Bouaghi and Relizane), which in turn include few tomato growers.

In terms of the mean of contracted and delivered quantities, the evidence from Table 1 shows that always MQ1 < MQ0. This conducts us to refer to the values of θ. Our index shows a value of –0.53 (i.e., 53%) for the whole sector with a mean of commitment percentage about 79%. Whereas, between regions within processors, it seems that Guelma has the lowest value (30%) and highest growers’ commitment (with 93.1%).

Interpreted as a ratio of contractual default, the index suggests that Oum Bouaghi, Tipaza and Guelma represent the lowest ratios of contractual default, while Taref, Skikda and Annaba as having values which in the neighborhood of the whole average. In terms of farm size, the values of the index θ show higher contractual default ratio for large farms, where small and medium farms present values close to the whole average.

As shown in the Table 1, the second line represents the whole sector. Particularly, the differential of the means of contracted and delivered quantities has a significant magnitude. In order to illustrate this difference more accurately, Figures 5 and 6 display the estimated frequency distributions for the contracted and delivered tomato quantity respectively.

Figure 5 shows a modal value of 300 tons for the contracted quantity, whereas the effectively produced and delivered quantity (Figure 6) shows a modal value of 100 tons.

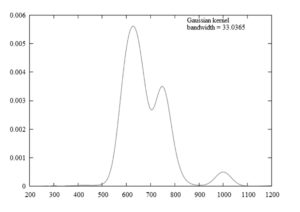

To illustrate more deeply the contractual terms, we present also the estimated frequency distributions for yields in tomato growers’ contracts. From the data we have, tomato production yields (expressed by the ratio of quantity on the cultivated area) computed through two measures: the expected yield expressed by the contracted quantity (in qx) on the cultivated area (in ha) and the real yield, i.e., the effectively produced and delivered quantity (in qx) on the cultivated area (in ha). Figures 7 and 8 show the estimated frequency distributions for expected and real yields respectively.

The expected yield (Figure 7) shows multimodal distribution with values from 600 qx/ha, to 750 qx/hq and even a value of 1000 qx/ha. But the result shown in Figure 8 (for real yields) reveals approximately the true values for tomato production yields. The resulted graph shows a slightly bimodal distribution which has two values of 400 and 600 qx/ha. The evidence from these results suggests that initial yields in contracts was over-estimated, and the real yield in tomato production has an average about 400 qx/ha (with a standard deviation of 204.6).

Figure 7 – Estimated Frequency Distribution for Expected Yields.

Figure 8 – Estimated Frequency Distribution for Real Yields.

In Table 2, we present results from the binary Logit regression estimation (with 3,740 observations) where the chosen governance structure is regressed on the farm size and yield. Before the modeling procedures, the collinearity was checked by using the Variance Inflation Factor for the twelve variables. The calculated VIF values are all less than 10 (1.0 for both variables), which indicated that collinearity is not a serious problem. The Adjusted R2 and the McFadden R2 coefficients are acceptably high and the resulted model fitness show higher overall significance level for the Log-likelihood ratio test with 94.5% of correctly predicted cases.

Table 2 – The Logit Regression Estimation Results of Contract Choice for Tomato Processing Industry in Algeria.

|

Explanatory Variables |

Coefficient Estimates |

p-value |

|

|

const. |

−15.522 (−20.610) |

<0.00001 |

*** |

|

Farm Size |

−0.062 (−2.576) |

<0.00001 |

*** |

|

Production Yield |

0.029 (21.060) |

<0.00001 |

*** |

|

Observations |

3,740 |

||

|

McFadden R-squared |

0.750 |

||

|

Adjusted R-squared |

0.749 |

||

|

Cases correctly predicted |

94.5% |

||

|

Likelihood ratio test: Chi-square (2) |

3,102.02 [0.0000] |

The results suggest that the variable of farm size has a statistically significant negative effect on the contract choice (coefficient estimate of −0.062 with z-statistics of −2.576), whereas the yield variable shows, in contrast, a statistically significant positive effect on the contract choice (coefficient estimate of 0.029 with z-statistics of 21.06). The estimated results from our model provide strong support for the hypothesis that farm scale and yield could be considered as significant determinants of vertical contractual form in the Algerian tomato industry (among other factors since the constant term has also a statistically significant effect).

6. Discussion and Policy Recommendations

The main results of this study can be summarized as follows: (1) Processing tomato industry is still concentrated, (2) higher levels of contractual default, (3) tomato growers are inadequately distributed, (4) yields are overestimated, and (5) farm scale and yield are significant determinants of vertical contracting.

Generally, the industrialization and the evolving structure of agricultural sector have been identified as an important factor influencing vertical coordination in food chain production stages (Barkema and Drabenstott, 1995; Hurt, 1994; Boehlje and Doering, 2000; Young and Hobbs, 2002). As admitted in the SCP paradigm, the market structure influences the performances as well as the actors’ behavior. In our case, the oligopsonic structure of tomato processors entails certainly a loss in social welfare (such as the exogenously predetermined price). Hence, tomato processors gain market power which should be mitigated by closer public intervention. This presents challenges for government to ensure that the social welfare losses and misallocation of resources that result from an abuse of market power are avoided (Young and Hobbs, 2002).

The higher levels of contractual default (reflected by the overall mean of θ index: 53%) can be explained by the relative weakness of incentives in contractual terms (specially related to price). The structure of the contract ignores the most important element of the exchange, the price. Nonetheless, contract choice has a significant share (79%), and this provides an evidence that the performance contract can be optimal even providing lesser quantity (and quality) than the spot market (Fernández-Olmos and Vinuesa, 2009). Besides, the over-estimation of farm yields is a proxy of information asymmetries between growers and processors. Growers have the advantage to expect the ideal yields for their farms. But in reality, they encounter some difficulties, specifically technical constraints of farm technology such as mechanization use, fertilizers quality, seed quality, and pesticides use. Closer vertical coordination between growers and processors in terms of technical assistance and partial control could help growers to attain their optimum yields. Moreover, the inadequate distribution of tomato growers among the regions gives rise to transportation costs problem. The impact of regional location of growers should be considered by policy-makers, and transportation costs should be incorporated in contractual terms.

The negative effect of farm size is due to the fact that small farmers are more sensitive to market risks. That is why small farms are likely to perform their contracts disregarding market price. In contrast to the empirical evidence advocating that vertical contracting is positively associated with the scale of production (Key, 2004; Kumar, 2007; Carillo, 2016), it has been asserted that small-scale producers with lower income are more risk-averse and less able to cope with market risks; thus, they would be expected to place more value on the risk-reducing property of contracts and would therefore be more likely to contract. This finding is corroborated by Key and Runsten (1999); Abebe et al., (2013); Sharma (2016); Kiwanuka and Machethe (2016).

Another alternative explanation can be highlighted in terms of bargaining power. It has been suggested that processors prefer to contract with smaller-scale producers because the bargaining strength of growers is inversely related to the scale of the contracting growers. Hence, the atomicity of small-scale farms insures higher levels of contractual performance. Moreover, the positive effect of yields indicates that more productive farms are more susceptible to perform contracts since higher yields imply the intensive input use and farm technology adoption. It has been claimed that technological advances, combined with continued pressures to control assets and improve quality, are expected to provide incentives for further industrialization of the industry (Boehlje and Doering, 2000). With special focus on food quality control, incorporating quality grading schemes would have desirable effects on industry performances; to the extent that several food certification schemes have recently been launched in the domestic markets of developing countries (Reardon et al., 2007; Faysse et al., 2017).

This research has some significant policy implications for the vertical coordination in Algerian processing tomato industry. First, the Algerian government should promote more competitive structure of processing tomato industry (which at present tends actually to an oligopsonic structure). This could strengthen the bargaining power of tomato processors. Second, the vertical contract between tomato grower and processor did not include fundamental clauses covering quality, enforcement terms, dispute settlement, contingencies, and exit options. Thus, the contract had a certain degree of incompleteness. This due mostly to ex ante and ex post transaction costs related to asymmetric information (indicated by lower levels of contractual performances). The inclusion of clauses on negotiated price, quality, and enforcement clauses add to contract more transparency and grower’s commitment.

Policy emphasis could as well be placed on mechanisms which recognize the importance of transport costs and technical assistance enabling tomato growers to enhance productivity, and consequently the contractual performance, such as access to extension services and market information. Another intervention area could be strengthening of collective action of small tomato growers by the formation of producer organizations, in order to counterbalance the oligopsonic power of tomato processors. Besides, the predictability nature of tomato price could an advantage for the regulation issue. Nonetheless, a freely negotiated price would be more advantageous for efficient contracting practice. These considerations may induce processors to offer more incentive contracts to growers.

7. Conclusion

This paper aimed to analyze vertical relationship between growers and processors in tomato processing industry. Since the Algerian Ministry of Agriculture has inaugurated last year (2016) a first experience for regulating this vertical relationship, an elementary analysis of the extensive data generated in this experience has permitted to us to establish some empirical evidences on the performances of vertical relationships in food supply chain.

The results of our analysis indicate that the vertical relationship between tomato grower and processor undergoes some deficiencies resulted in social welfare losses and lower level in contractual performance. From the side of processors, the industry has an oligopsonic structure. This is manifested in an exogenous predetermined price in contracts, on one hand, and the take-it-or-leave-it contract on the other hand. From the side of tomato growers, the results indicate a relatively higher contractual default (53% in average). This is may be a consequence of the simplistic form of contract lacking for flexibility and incentives. The inadequately distributed growers, asymmetric information, farm scale and yield (farming technology) could be the major sources of the lower performance in contractual arrangements.

This paper provides some interesting implications from agricultural policy perspective in Algeria. The main recommendations from this study emphasize firstly on the progress toward more competitive structure for tomato processors, based on the fact that competition plays a pivotal role given the absence of market price information in a vertically linked system. Secondly, we recommend also some improvements for the contract incompleteness mainly the incorporation of basic clauses such as negotiated price, quality, and enforcement clauses. The Algerian government should play a strategic role to regulate more efficiently tomato grower-processor contract in order to facilitate vertical coordination in the food system, cutting back on its lower performances by leveraging vertical contract through policy mechanisms for tomato growers’ benefit.

The vertical contractual relationship in Algerian tomato industry faces more challenges, and it should move toward a closer integrated production contract. Further deeper research would be helpful for more understanding of the performance along food supply chain in Algeria.

References

Abebe G.K., Bijman J., Kemp R., Omta O. and Tsegaye A., 2013. Contract Farming Configuration: Smallholders’ Preferences for Contract Design Attributes. Food Policy, 40: 14-24.

Barkema A. and Drabenstott M., 1995. The Many Paths of Vertical Coordination: Structural Implications for the U.S. Food System. Agribusiness: An International Journal, 11(5): 483-492.

Bencharif A. and Rastoin J.L., 2007. Concepts et méthodes de l’analyse de filières agroalimentaires: Application par la chaîne globale de valeur au cas des blés en Algérie. Montpellier: UMR MOISA.

Bencharif A., 2006. Une brève notion de la filière: Au-delà des modes et des ambigüités, une démarche stratégique. In: Hassainya J., Padilla M. and Tozanli S. (eds), Lait et produits laitiers en Méditerranée: Des filières en pleine restructuration. Paris: Éditions Karthala.

Bijman J., 2008. Contract Farming in Developing Countries: An Overview. Working papers, Wageningen University.

Boehlje M. and Doering O., 2000. Farm Policy in an Industrialized Agriculture. Journal of Agribusiness, 18(1): 53-60.

Boussard J-M., 2007. La volatilité des prix, le marché, et l’analyse économique. Économie Rurale, 300: 71-74.

Bouzid A. and Bedrani S., 2013. La performance économique de la filière tomate industrielle en Algérie. Les cahiers du CREAD, 103: 85-105.

Bouzid A. and Padilla M., 2014. Analysis of Social Performance of the Industrial Tomatoes Food Chain in Algeria. New Medit, 1: 60-65.

Carillo F., 2016. Vertical Integration in Italian Pasta Supply Chain: A Farm Level Analysis. Rivista di Economia Agraria, LXXI(1): 47-66.

Cook R., 2011. Fundamental Forces Affecting U.S. Fresh Produce Growers and Marketers. Choices: The Magazine of Food, Farm and Resource Issues, 26(4).

Dileep B.K., Grover R.K. and Rai K.N., 2002. Contract Farming in Tomato: An Economic Analysis. Indian Journal of Agricultural Economics, 57(2): 197.

Faysse N., Rais I., Ait El Mekki A. and Jourdain D., 2017. Prospects for a Certified Mint Supply Chain in Morocco Based on an Assessment of Consumers’ Willingness to Pay. New Medit, 16(2): 47-54.

Fernández-Olmos M. and Vinuesa L.M.M., 2009. Spot Market versus Incentive Contract. New Medit, 3: 12-20.

Gérard F., Alpha A., Beaujeu R., Boussard J-M., Levard L., Maitre d’Hotel E., Rouille d’Orfeuil H., Bricas N., Daviron B., and Galtier F., 2011. Managing Food Price Volatility for Food Security and Development. GREMA.

Goodhue R.E., Mohapatra S. and Rausser G.C., 2010. Interactions Between Incentive Instruments: Contracts and Quality in Processing Tomatoes. American Journal of Agricultural Economics, 92(5): 1283-1293.

Gunes E., 2006. Agribusiness and Contract Farming: The Case of Tomato Production in Turkey. The X International Symposium on the Processing Tomato, 758: 299-304.

Gunes E., 2007. The Econometric Analysis of Tomato Production with Contracting in Turkey. Journal of Applied Sciences, 7(14): 1981-1984.

Guo H., and Jolly R.W., 2008. Contractual Arrangements and Enforcement in Transition Agriculture: Theory and Evidence from China. Food Policy, 33(6): 570-575.

Hueth B. and Ligon E., 2002. Estimation of an Efficient Tomato Contract. European Review of Agricultural Economics, 29(2): 237-253.

Hueth B., Ligon E., Wolf S. and Wu S., 1999. Incentive Instruments in Fruit and Vegetable Contracts: Input Control, Monitoring, Measuring and Price Risk. Applied Economic Perspectives and Policy, 21(2): 374-389.

Hueth B. and Ligon E.,1999. Producer Price Risk and Quality Measurement. American Journal of Agricultural Economics, 81(3): 512-524.

Hurt C., 1994. Industrialization in the Pork Industry. Choices: The Magazine of Food, Farm and Resource Issues, 4: 9-13.

Joskow P.L., 2008. Vertical Integration. In: Ménard C. and Shirley M.M. (eds.). Handbook of New Institutional Economics. Netherlands: Springer, 319-348.

Joskow P.L., 1985. Long Term Vertical Relationships and the Study of Industrial Organization and Government Regulation. Journal of Institutional and Theoretical Economics, 141(4): 586-593.

Katz M.L., 1989. Vertical Contractual Relations. In: Schmalensee R. and Willig D. (eds). Handbook of Industrial Organization. Elsevier Science Publishers, 655-721.

Key N., 2004. Agricultural Contracting and the Scale of Production. Agricultural and Resources Economics Review, 33: 255-271.

Key N. and Runsten D., 1999. Contract Farming, Smallholders, and Rural Development in Latin America: The Organization of Agroprocessing Firms and the Scale of Outgrower Production. World Development, 27(2): 381 S 401.

Kiwanuka R.N.L. and Machethe C., 2016. Determinants of Smallholder Farmers’ Participation in Zambian Dairy Sector’s Interlocked Contractual Arrangements. Journal of Sustainable Development, 9(2): 230-245.

Kumar P., 2007. Contract Farming through Agribusiness Firms and State Corporation: A Case Study in Punjab. Economic and Political Weekly, 41(52): 5367-5375.

Ligon E., 2001. Contractual Arrangements for Fresh Produce in California. Agricultural and Resource Economics Update, 5(2), 1-2.

MacDonald J., Perry J., Ahearn M., Banker D., Chambers W., Dimitri C., Key N., Nelson K. and Southard L., 2004. Contracts, Markets and Prices: Organizing the Production and Use of Agricultural Commodities. Washington DC: U.S. Department of Agriculture, ERS, Agr. Econ. Rep. 837.

Mighell R.L. and Jones L.A., 1963. Vertical Coordination in Agriculture. Washington, DC: U.S. Department of Agriculture, ERS, AER No. 19.

Mishra A.K. and Perry J.E., 1999. Forward Contracting of Inputs: A Farm-Level Analysis. Journal of Agribusiness, 17(2): 77-91.

Monteiro G.F.A., Saes M.S.M., Caleman S.M.D.Q. and Zylbersztajn D., 2012. The Role of Empirical Research in the Study of Complex Forms of Governance in Agroindustrial Systems. Revista de Economia e Sociologia Rural, 50(4): 667-682.

Montigaud J.C., 1989. Filière fruits et légumes et la grande distribution : Méthode d’analyse et résultats économiques des filières en régions chaudes. Actes du Dixième Séminaire d’Economie et de Sociologie. Montpellier, France.

Oliveira M.F.L., 2008. The Portuguese Tomato Processing Sector: Market Structure, Concentration and Firm Behavior. New Medit, 2: 23-30.

Perry M.K., 1989. “Vertical Integration: Determinants and Effects”, in: Schmalensee R. and Willig D. (eds), Handbook of Industrial Organization. Elsevier Science Publishers, 184-255.

Rangi P.S. and Sidhu M.S., 2000. A Study on Contract Farming of Tomato in Punjab. Agricultural Marketing, 42(4): 15-23.

Reardon T., Henson S. and Berdegué J., 2007. Proactive Fasttracking Diffusion of Supermarkets in Developing Countries: Implications for Market Institutions and Trade. Journal of Economic Geography, 7(4): 399-431.

Sexton R.J. and Lavoie N., 2001. “Food Processing and Distribution: An Industrial Organization Approach”, in: Gardner B. and Rausser G. (eds), Handbook of Agricultural Economics. Elsevier Science Publishers, 863-932.

Sharma N., 2016. Determining Growers’ Participation in Contract Farming in Punjab. Economic and Political Weekly, LI(2): 58-65.

Tatlidil F.F. and Akturk D., 2004. Comparative Analysis of Contract and Non-Contract Farming Model in Tomato Production. Journal of Agronomy, 3(4): 305-310.

Vassalos M., Hu W. and Woods T., 2015. Risk Preferences, Transaction Costs, and Choice of Marketing Contracts: Evidence from a Choice Experiment with Fresh Vegetable Producers. Agribusiness, 32(3): 379-396.

Wolf S., Hueth B. and Ligon E., 2001. Policing Mechanisms in Agricultural Contracts. Rural Sociology, 66(3): 359-381.

Young L.M. and Hobbs J.E., 2002. Vertical Linkages in Agri-Food Supply Chains: Changing Roles for Producers, Commodity Groups, and Government Policy. Review of Agricultural Economics, 24(2): 428-441.

Zhu H. and Wang X., 2007. An Analysis on the Influencing Factors of Tomato Growers’ Participation in Contract Farming in Xinjiang Autonomous Region. Chinese Rural Economy, 7: 67-75.